Australian Dollar experienced a significant surge in today’s Asian trading session, fueled in part by the vigorous rebound observed in Hong Kong stocks, the Chinese Yuan, and Copper prices. The rebound in stocks could attributed possible position adjustments after a tumultuous quarter in Hong Kong and China, and with the impending long holiday in China lasting until October 9. But there’s still a budding sentiment of optimism concerning China’s potential for economic recuperation.

A noteworthy comment from the International Monetary Fund has contributed to this optimism. The IMF recently expressed its observation yesterday of certain stabilization signs in China’s economy from the latest data sets. The institution holds a perspective that China could realistically achieve growth rate close to 5% this year. Looking forward, the IMF anticipates China’s GDP growth to decelerate to approximately 3.5% over a medium-term horizon. Nevertheless, this pace could experience a boost if China embarks on economic reforms.

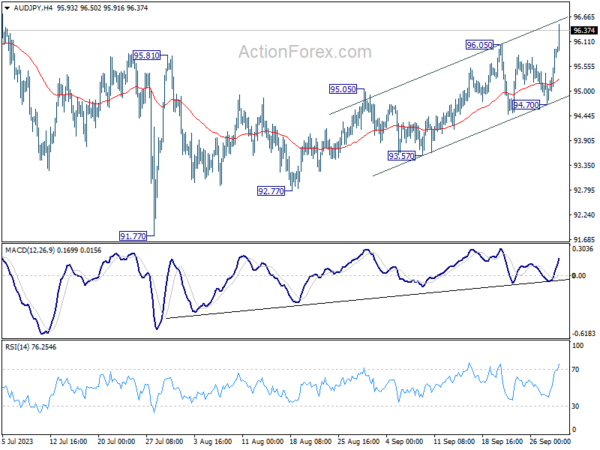

AUD/JPY has powerfully broken 96.05 resistance mark, which is indicative of resumption of its recent rise from the 92.77. However, the nature of the current rally doesn’t explicitly suggest it’s impulsive, maintaining an air of ambiguity around potential technical interpretations.

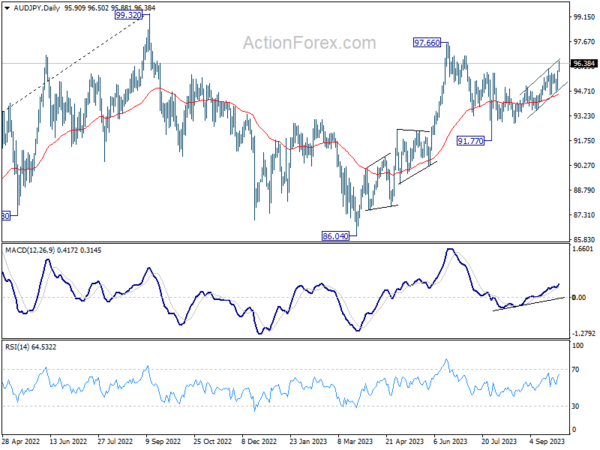

In one scenario, if price action from 91.77 serves as the second leg of the pattern originating from 97.66, then the peak of the current rally might be restricted by 97.66 resistance.

In another case, if the upswing from 91.77 is in continuation with the entire surge from 86.04, the climb could still be seen as the second leg of the pattern from the 2022 high of 99.32. As such, the upper boundary could be set by the 99.32 mark, even if 97.66 is surpassed.

So, upside potential appears to be limited for the medium term.

Turning to Copper, its robust rebound this week suggests that decline from 4.0145 might have culminated, completing three waves that bottomed at 3.6008. Sustained trading above 55 D EMA (now at 3.7540) would solidify this viewpoint, setting sights on 3.8762 resistance for validation.

For Australian Dollar to secure its foundational momentum, decisive break of 3.8762 resistance in Copper might be essential. Absent this, Aussie’s rebound might retain its corrective nature.