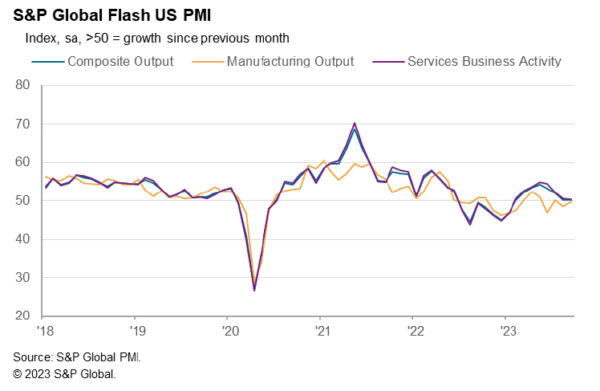

US PMI Manufacturing rose from 47.9 to 48.9 in September. PMI Services fell from 50.5 to 50.2, an 8-month low. PMI Composite fell from 50.2 to 50.1, a 7-month low.

Siân Jones, Principal Economist at S&P Global Market Intelligence said:

“PMI data for September added to concerns regarding the trajectory of demand conditions in the US economy following interest rate hikes and elevated inflation. Although the overall Output Index remained above the 50.0 mark, it was only fractionally so, with a broad stagnation in total activity signalled for the second month running. The service sector lost further momentum, with the contraction in new orders gaining speed.

“Subdued demand did not translate into overall job losses in September as a greater ability to find and retain employees led to a quicker rise in employment growth. That said, the boost to hiring from rising candidate availability may not be sustained amid evidence of burgeoning spare capacity and dwindling backlogs which have previously supported workloads.

“Inflationary pressures remained marked, as costs rose at a faster pace again. Higher fuel costs following recent increases in oil prices, alongside greater wage bills, pushed operating expenses up. Weak demand nonetheless placed a barrier to firms’ ability to pass on greater costs to clients, with prices charged inflation unchanged on the month.”