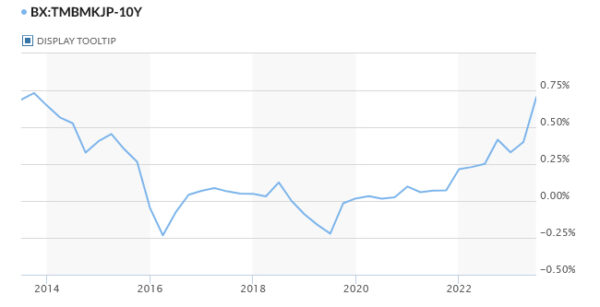

Yen saw a notable uptick in Asian session, buoyed by hawkish sentiments by BoJ Governor Kazuo Ueda. Concurrently, 10-year JGB yield scaled its highest level in nine years, breaching 0.7% mark.

In an interview with Yomiuri newspaper published over the weekend, Ueda hinted at the possibility that BoJ might have sufficient data by the close of the year to contemplate ending its negative interest rate policy. Such remarks from Ueda have spurred speculation among market analysts, with some interpreting them as early signals for the markets, suggesting a potential end to negative interest rates by Q1 2024. Before this step, there also are anticipations of yield curve control being phased out later this year.

On the flip side, certain analysts, referencing recent data which highlights decelerating wage growth, argue that the transition from negative rates might not be imminent. They believe Ueda’s remarks might be more of a countermeasure to Yen’s recent depreciation.

Ueda, during the interview, emphasized the need for Japan to witness a consistent rise in inflation, complemented by wage growth, before implementing changes. “If we judge that Japan can achieve its inflation target even after ending negative rates, we’ll do so,” Ueda asserted. However, he also reiterated the central bank’s stance on maintaining its ultra-loose policy for now, until there’s firm confidence that inflation will consistently hover around the 2% mark, bolstered by robust demand and wage growth.

He cautioned, “While Japan is showing budding positive signs, achievement of our target isn’t in sight yet.” Looking ahead, Ueda underscored the importance of wage trajectories in the coming year, indicating that conclusive decisions would be data-driven. “We can’t rule out the possibility we’ll get enough information and data by year-end,” Ueda added.