Silver’s impressive rally intensified yesterday, pulling Gold upwards in its wake. This surge seems to be a direct response to the retracement of benchmark treasury yields in both the US and Europe, which were affected by less-than-stellar PMI figures. Market sentiment is now swaying towards the belief that major central banks might be quickly approaching the finale of their tightening cycle. All eyes are set on upcoming Jackson Hole Symposium. While the spotlight is certainly on the speech by Fed Chair Jerome Powell, insights and comments from other prominent central bankers are also poised to influence market directions.

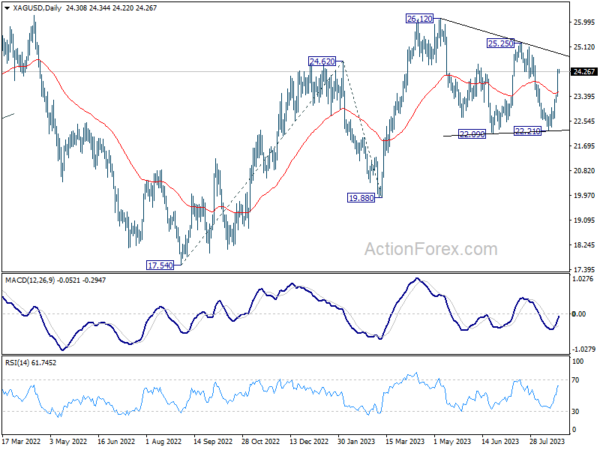

Technically, Silver’s strong break of 55 D EMA affirms the case that consolidation pattern from 26.12 has completed with three waves to 22.21. Further rise is now expected as long as this 55 D EMA (now at 23.56) holds, to 25.25 resistance first. Decisive break there should confirm this bullish case, and should also resume whole up trend from 17.54 (2022 low). Next target would be 100% projection of 17.54 to 24.62 from 19.88 at 26.96.

As for Gold, a short term bottom is in place at 1884.83, with D MACD crossed above signal line. Further rebound is now in favor to 55 D EMA (now at 1932.52). Sustained break there will argue that whole corrective pattern from 2062.95 has completed with three waves down to 1884.83, after defending 38.2% retracement of 1614.60 to 2062.95 at 1891.68. Stronger rally would then be seen to 1987.22 resistance to confirm this bullish scenario.