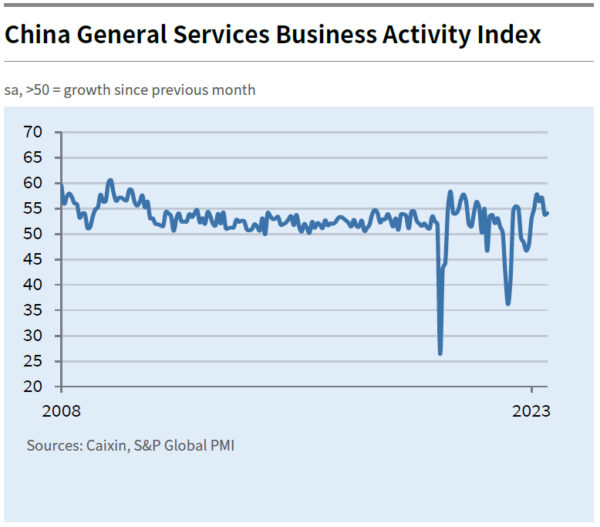

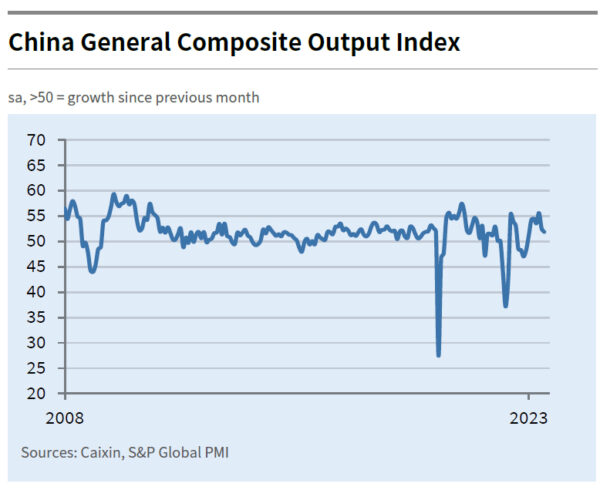

China’s Caixin PMI Services increased slightly from 53.9 to 54.1 in July, surpassing the anticipated figure of 52.5. However, this reading fell short of the 55.5 average seen over the previous six months. Concurrently, PMI Composite dropped from 52.5 to 51.9, its lowest mark since January.

Commenting on the latest figures, Wang Zhe, a Senior Economist at Caixin Insight Group, expressed that the uneven recovery of the service and manufacturing industries remains a prominent concern. He noted, “Although the manufacturing sector was a drag, the steady expansion of the services industry still helped overall output, demand, and employment remain in positive territory.”

The contraction in exports appeared pronounced, and while input costs saw a slight uptick, output prices registered a minor drop. Despite these challenges, expectations for future output remained on the optimistic side, though this metric recorded a new low since November.

On the broader economic landscape, Wang Zhe noted, “Although the data for industrial production and investment in June showed some signs of recovery, macroeconomic growth remained sluggish, and considerable downward pressure on the economy persisted.”

Turning to policy recommendations, he emphasized the need for employment guarantees, stabilization of expectations, and boosting household income. He further argued that “At present, monetary policy only has a limited effect on boosting supply. An expansionary fiscal policy that targets demand should be prioritized.”