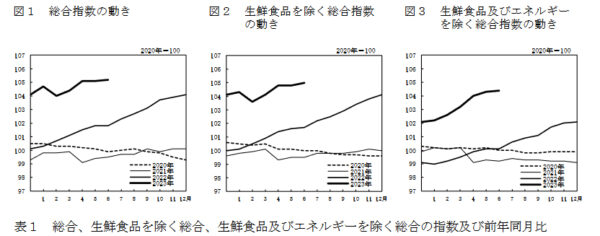

Japan’s Core CPI, which excludes food, matched expectations, also ticked up from 3.2% yoy to 3.3% yoy. This marks the 15th month that the inflation reading has remained above BoJ’s 2% target.

Meanwhile, CPI core-core, which excludes both food and energy, dropped marginally from 4.3% yoy to 4.2% yoy, aligning with expectations. This slight decrease represents the index’s first slowdown since January 2022. Headline CPI edged higher from 3.2% yoy to 3.3% yoy in June, surpassing 3.2% yoy expectation.

Looking at some details, service prices slightly decelerated from 1.7% yoy to 1.6% yoy. Nevertheless, food prices remained robust, rising by 9.2% yoy. A significant increase was also observed in durable household goods, which rose by 6.7% yoy. Conversely, energy prices fell by -6.6% yoy.

These figures raises the probability of BoJ making an upward revision to its inflation outlook for the current fiscal year, with its two-day policy-setting meeting slated for next week. However, BOJ might still perceive the economy as being far from a virtuous cycle of higher wages, robust consumption, and further price hikes. As Governor Kazuo Ueda indicated earlier this week, if this assumption holds true, “our overall narrative on monetary policy remains unchanged.”