As BoE gears up for its monetary policy decision today, market observers find themselves divided on the scale of the expected rate hike. This indecision comes in the wake of a consumer inflation report released yesterday that muddied the waters. Headline CPI for May remained static at 8.7%, exceeding BoE’s own forecasts, while core CPI climbed to 7.1%, reaching its highest level since 1992.

Market participants are currently betting on a 40% probability of a more substantial 50bps increase to 5.00%, and a 60% chance of a modest 25bps hike. The critical shift also lies in elevated projections for the terminal rate, which has shot up to 6.00%, a marked rise from below 5% merely a month ago.

The verdict for today’s decision will also pivot significantly on the voting breakdown, which will serve as a bellwether for BoE’s future steps. Known doves Silvana Tenreyro and Swati Dhingra are more likely to vote against any changes. The real wildcard, however, is how many of the remaining seven members will advocate for a 50bps hike, even if a 25bps increase is ultimately implemented.

SNB is also expected to announce its own rate hike from the current 1.50%. Chairman Thomas Jordan has signalled that interest rates may need to ascend above 2% threshold – a restrictive level – to reel inflation back below 2% mark. The quotes lies in timing of the attainment of this peak rate. Presently, the likelihood of either a 25bps or a 50bps hike today seems evenly split, making it a nail-biter.

Some previews on BoE and SNB:

- Will the BoE Appear Hawkish Enough to Push the Pound Higher?

- Bank of England Preview – Look to Sell GBP on Aggressive BoE Pricing

- SNB to Raise Rates, But Will It Be Enough to Lift the Franc?

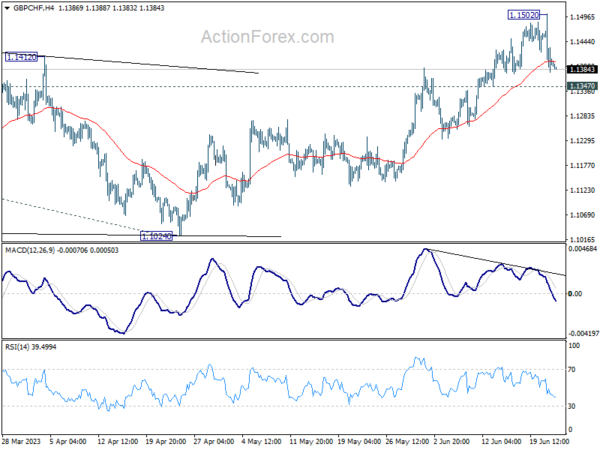

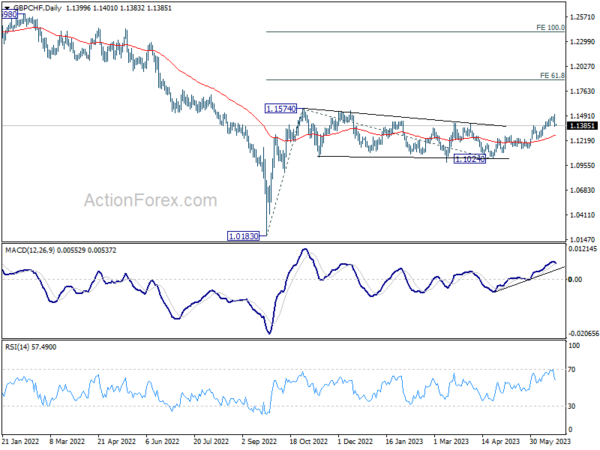

GBP/CHF’s rally was choked after hitting 1.1502 earlier in the week, kept below 1.1574 resistance. For now, the favored case is still that triangle consolidation pattern from 1.1574 has completed at 1.1024. Rise from 1.1024 is seen as resuming the whole rally from 1.0183. Decisive break of 1.1574 will confirm this bullish case and target 61.8% projection of 1.0183 to 1.1574 from 1.1024 at 1.1884. However, firm break of 1.1347 support will dampen this view, and extend the pattern from 1.1574 with another fall.