According to RBNZ Q2 Survey of Expectations (Business), inflation expectations for the year ahead took a notable dip, marking the largest drop since June 2020. The one-year-ahead inflation expectation declined by -83 basis points, moving from 5.11% down to 4.28%.

Further into the future, expectations for inflation over a two-year period also demonstrated a decrease. The mean two-year-ahead inflation expectation fell by -51 basis points from 3.30% to 2.79%, placing it back within RBNZ’s target band of 1-3% for the first time since December 2021. The survey also found that the spread of responses has narrowed compared to the previous quarter, with a lower quartile of 2.00% and an upper quartile of 3.00%.

The survey’s respondents also projected changes in the Official Cash Rate. By the end of June 2023, the OCR is expected to rise to 5.47%, an increase of 58 basis points from the last quarter’s mean estimate of 4.89%. However, expectations suggest the OCR will fall back to 4.84% by March 2024, down from the previous quarter’s estimate of 5.00%.

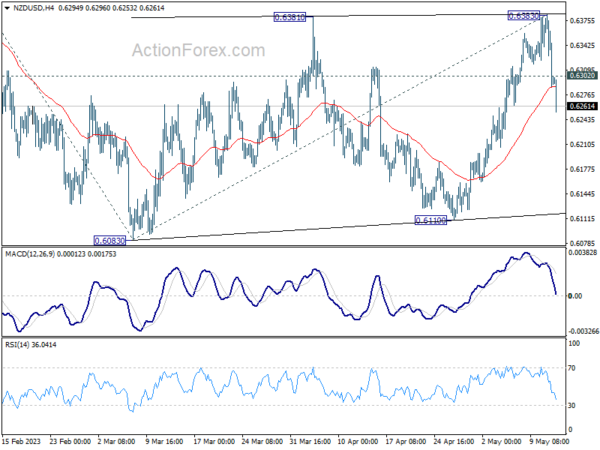

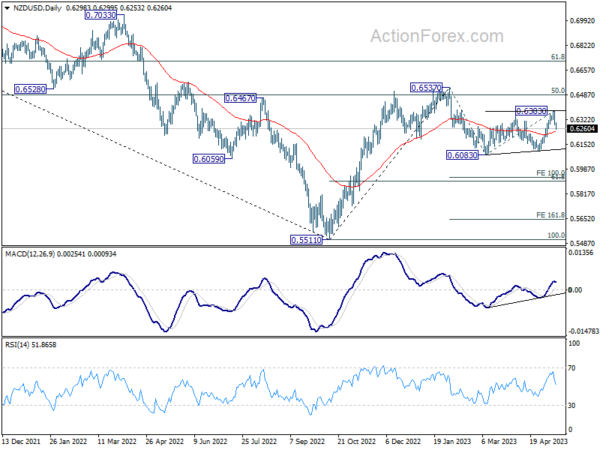

NZD/USD falls notably after the release and broke through 55 4H EMA decisively. The development suggests that rebound from 0.6110 has completed at 0.6383. More importantly, whole corrective pattern from 0.6083 might finished in a three-wave structure too. Deeper decline is now in favor back to retest 0.6083/6110 support zone. Decisive break there will resume whole fall from 0.6537. Meanwhile, break above 0.6302 minor resistance will mix up the near term outlook first.