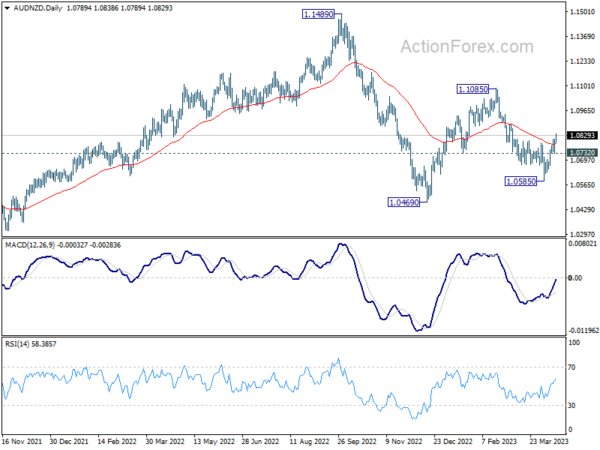

AUD/NZD continues to extend its rebound from 1.0585 short-term bottom, prompting traders to further close their short positions as the previous selloff failed to push the cross through 1.0469 low. Market participants are awaiting the release of RBA minutes in the upcoming Asian session, along with Australian PMIs and New Zealand CPI data this week.

Expectations on New Zealand’s CPI remain divided, with some anticipating a slowdown from 7.2% yoy level. If realized, this would fall below RBNZ’s forecast of 7.3%, potentially sparking speculation of a less aggressive rate hike path. Conversely, improvements in Australia’s PMI could bolster RBA’s confidence in resuming tightening with another rate hike in May.

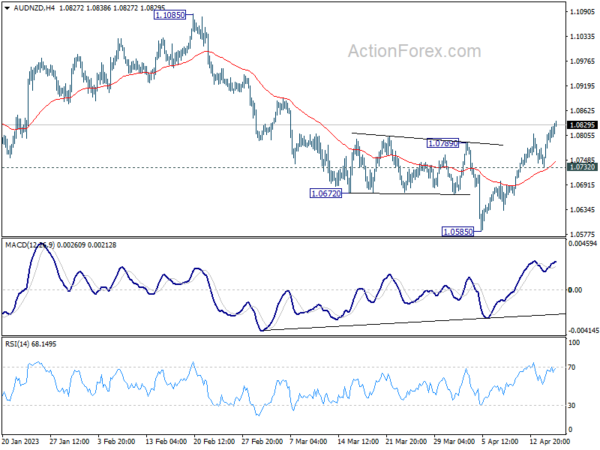

Technically, break of 1.0789 resistance now argues that fall from 1.1085 has completed at 1.0585. Rise from there could be seen as the third leg of the pattern from 1.0469. Further rally could be seen back to 1.1085 resistance next. However, on the downside, break of 1.0732 support will bring retest of 1.0585 low instead.