EUR/USD has broken out to the upside following a lower-than-expected headline inflation reading in the US. While the uptick in core CPI still supports another rate hike by Fed in May, the overall data set raises hopes that the disinflation process is ongoing and perhaps even gathering momentum. This development bolsters the confidence of those betting on a Fed rate cut later this year.

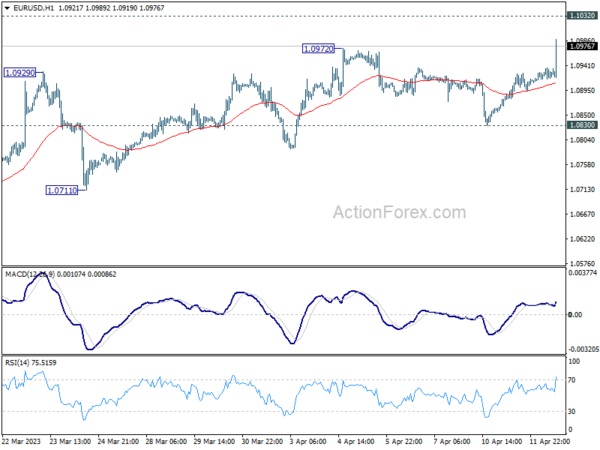

Technically, EUR/USD is expected to face resistance at 1.1032 shortly. A decisive break above this level would resume the overall uptrend from the 2022 low of 0.9534. Next target is the 61.8% retracement of 1.2348 (2021 high) to 0.9534, which stands at 1.1273.