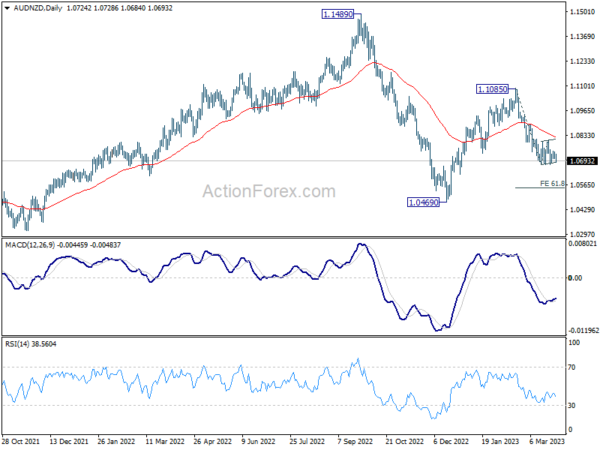

AUD/NZD is trading slightly lower following the release of Australia’s lower-than-expected monthly CPI data, which bolsters the case for a pause in RBA’s tightening cycle next week. While there are talks of another 25bps RBA rate hike in May, taking rate to 3.85%, it would still be 90bps below RBNZ’s current rate of 4.75%. Furthermore, RBNZ is expected to increase rates by an additional 25bps to 5.00% in April, further widening the gap between the two central banks.

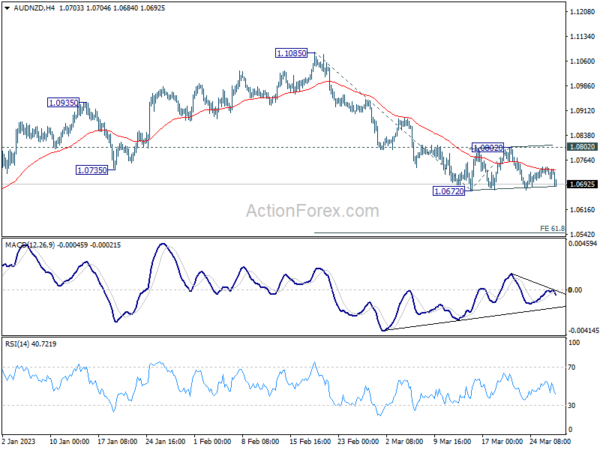

Technically speaking, AUD/NZD’s price movements from 1.0672 appear to be corrective in nature. Rejection by 4 hour 55 EMA suggests that the decline from 1.1085 could resume soon. A break below 1.0672 would confirm the resumption of the fall and target 61.8% projection of 1.1085 to 1.0672 from 1.0802 at 1.0547. In any case, outlook will remain bearish as long as 1.0802 resistance level holds.