SNB raises its policy rate by 50bps to 1.50% as widely expected. The central bank indicated the openness to further tightening while inflation forecasts are raised due to stronger second-round effects and increased overseas inflationary pressure.

The central bank said the rate hike is for “countering the renewed increase in inflationary pressure”. It also noted in the statement, “it cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.” It also remains “willing to be active in the foreign exchange market” with focus on “selling foreign currency” for some quarters.

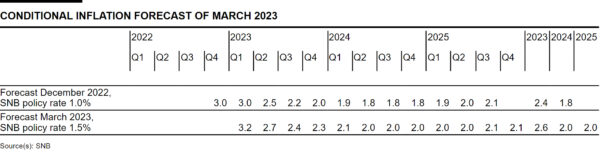

The bank’s conditional inflation forecast assumes an interest rate of 1.5% over the horizon. Average inflation estimates for 2023 and 2024 were raised from 2.4% to 2.6% and from 1.8% to 2.0%, respectively. Inflation is projected to average 2.0% in 2025, a new forecast.

SNB statement highlighted that “stronger second-round effects and the fact that inflationary pressure from abroad has increased again mean that, despite the raising of the SNB policy rate, the new forecast is higher through to mid-2025 than in December.”

The central bank anticipates a modest GDP growth of around 1% for the year, citing subdued foreign demand and the dampening effect of inflation on purchasing power.