Credit Suisse’s measures to ease investor concerns over potential contagion and a banking crisis have failed to lift market pressures, with the Asian markets remaining under pressure.

The bank announced it would borrow up to CHF50B from the SNB, calling it a “decisive action to pre-emptively strengthen its liquidity.” The loan and a repurchase of billions of dollars of Credit Suisse debt aim to manage its liabilities and interest payment expenses.

Earlier, in a joint statement with the Swiss financial market regulator FINMA, the SNB assured the markets that the Credit Suisse had met “strict capital and liquidity requirements” and said, “there are no indications of a direct risk of contagion for Swiss institutions due to the current turmoil in the US banking market.”

“If necessary, the SNB will provide CS with liquidity,” FINMA and SNB said.

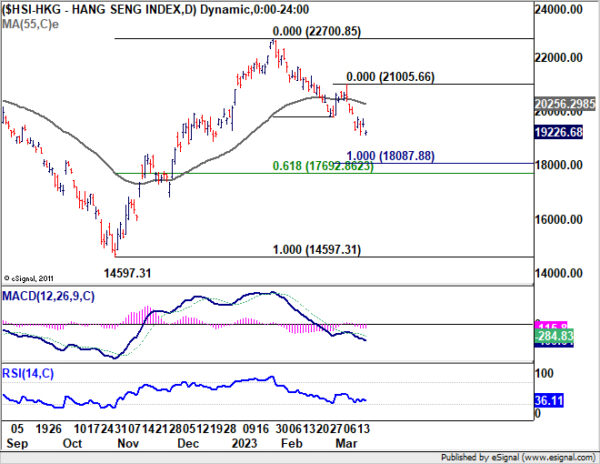

Hong Kong HSI gapped down today and is trading down -1.6% at the time of writing. From a technical perspective, the index’s decline from 22700.85 is still ongoing, and unless the 55-day EMA (now at 20256.19) is breached, a further decrease is anticipated. Even as a corrective move, this drop could aim for the 100% projection of 22700.85 to 19783.07 from 21005.66 at 18087.88.