In the Statement on Monetary Policy, RBA reiterated that “further increases in interest rates will be needed to ensure that the current period of high inflation is only temporary.”

“In assessing how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.”

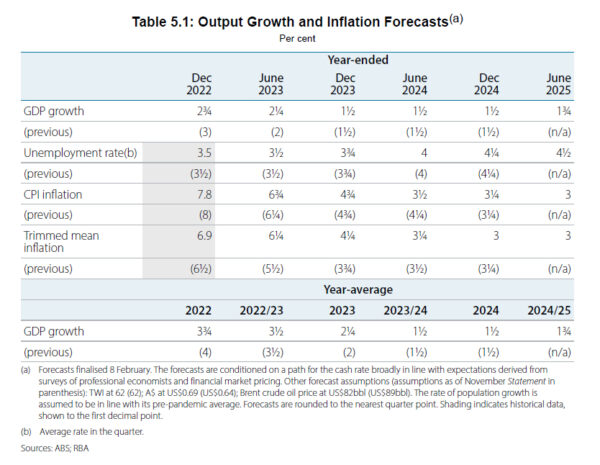

The economy is not forecast to contract within the projection horizon. Meanwhile, trimmed mean inflation is projected to stay higher and longer till mid 2024.

Year-average GDP growth forecast to be (from 3.75% in 2022):

- 2.25% in 2023 (unchanged from prior forecast).

- 1.50% in 2024 (unchanged).

- 1.75% in 2024/25 year (new).

Headline CPI (7.8% in December 2022) is projected to slow to:

- 6.75% in June 2023 (unchanged).

- 4.75% in December 2023 (unchanged).

- 3.50% in June 2024 (down from 4.25%).

- 3.25% in December 2024 (unchanged).

- 3.00% in June 2025 (new).

Trimmed mean CPI (6.9% in December 22) is projected to slow to:

- 6.25% in June 2023 (up from 5.50%).

- 4.25% in December 2024 (up from 3.75%).

- 3.25% in June 2024 (down from 3.50%).

- 3.00% in December 2024 (down from 3.25%).

- 3.00% in June 2025 (new).