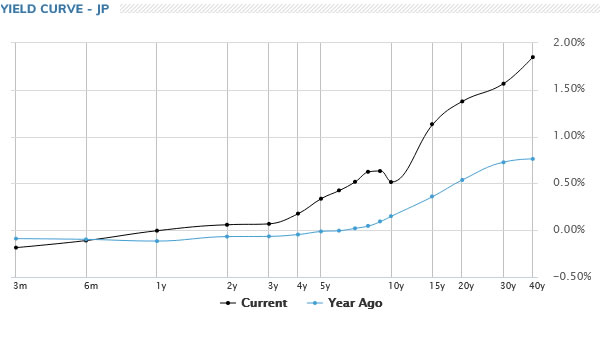

Japanese stocks, bonds and currency market remain rather nervous today, as traders are eyeing BoJ policy decision on Wednesday. The yield curve “distortion”, as described by the central bank, was getting more serious after 8- and 9-year yield surged past 0.6% handle last week. At the same time, 10-year JGB yield, closed at 0.514, is still firmly tied to the 0.5% cap. Both 8- and 9-year yield closed down but stayed above 10-year’s level at 0.624 and 0.632.

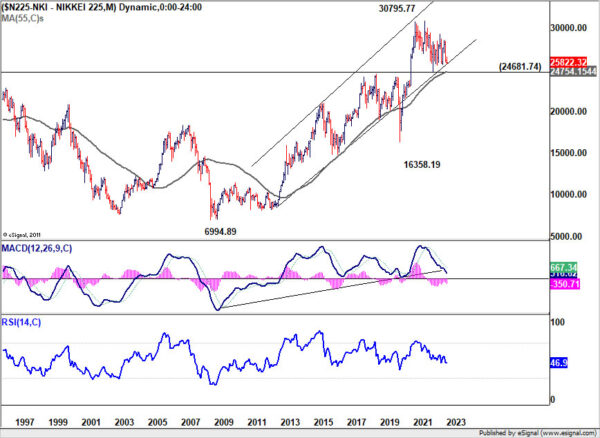

As speculation on a YCC tweak to rectify the distortion intensified , Nikkei declined -1.14% to close at 25822.32. Technically speaking, while deeper decline is possibly for the near term, strong support should be seen around 24681.74 to contain downside. The level is close to 55 month EMA, which stands at 24754.15. Nikkei has been continuously supported by the EMA, as well as the long term channel, for a decade, barring the initial two months of the pandemic. But a firm break of 24681.74 will indicate something rather substantial is happening.