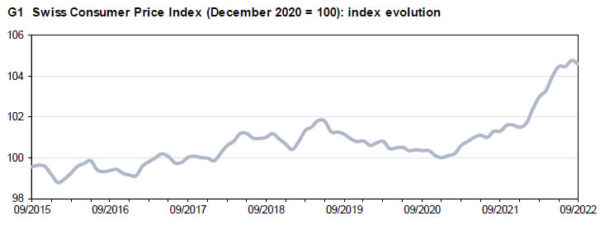

Swiss CPI dropped -0.2% mom in September, below expectation of 0.1% mom. The decrease of 0.2% compared with the previous month can be explained by several factors including falling prices for fuels, heating oil, hotels and supplementary accommodation. In contrast, prices for clothing and footwear increased.

Comparing with the same month a year ago, CPI slowed to 3.3% yoy, down from 3.5% yoy, below expectation of 3.5% yoy. Core CPI (excluding fresh and seasonal products, energy and fuel) was flat mom, up 2.0% yoy (unchanged from August). Domestic product prices rose 1.8% yoy (unchanged from August). Imported product prices rose 7.8% yoy (down from 8.6% yoy in August).

EUR/CHF rises further as Swiss CPI unexpectedly slowed. Immediate focus is now on 0.9712 resistance. Firm break there will raise the chance of larger bullish reversal, and target 0.9864 structural resistance for confirmation.