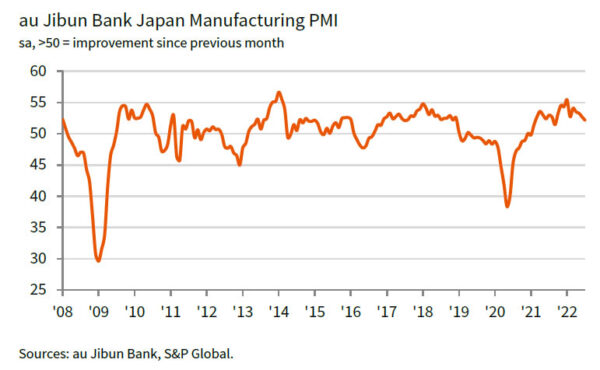

Japan PMI Manufacturing was finalized at 52.1 in July, down from June’s 52.7. That’s the lowest level since September 2021. S&P Global said there were renewed reductions in output and new orders. The softest rise in outstanding business 17 months was due to weaker demand. Rising prices and delivery delays led to accelerated stock building.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “The Japanese manufacturing sector saw a modest improvement in operating conditions at the start of the second half of the year, however the headline PMI masked some worrying trends when looking at the underlying sub-indices, which add downside risks for the sector. New order inflows fell for the first time in ten months and at the fastest pace since November 2020, which contributed to a renewed contraction in production levels – the first since February.

“Weaker demand conditions also contributed to reduced pressure on operating capacity. Backlogs of work increased at the softest rate in 17 months, which hints at a further weakening of output over the coming months.

“Anecdotal evidence also pointed to an acceleration in stock building activity among Japanese goods producers. Firms often cited that rising prices and delivery delays had led to greater purchasing activity and holdings of raw materials and other inputs, while delays meant that manufacturers held on to finished items until logistical capacity improved.

“Beyond the immediate future, firms remained confident about the year-ahead outlook for output, though the degree of optimism was little-changed from June. That said, increased downside risks from price and supply pressures remain apparent. S&P Global estimates that industrial production will rise only 0.2% in 2022, meaning that output lost to the pandemic is unlikely to be recovered until the start of 2024.”