SNB surprises the markets by raising the sight deposit rate by 50bps to -0.25% today, “to counter increased inflationary pressure”. It also adopts a tightening bias and said, “it cannot be ruled out that further increases in the SNB policy rate will be necessary in the foreseeable future to stabilise inflation in the range consistent with price stability over the medium term.” SNB also maintains the willingness to intervene in the currency markets if necessary.

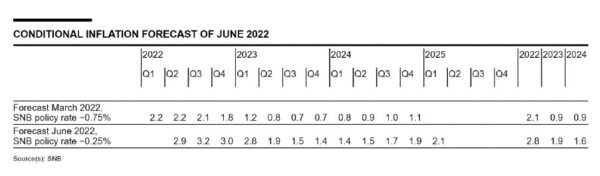

Even with higher interest rates, the conditional inflation forecasts were also raised across forecast horizon. Inflation is projected to peak at 3.2% in Q3, then slow to below 1.4% in Q4 2023, then rise back to 2.1% in Q1 2025. Average inflation is forecasts to be at 2.8% in 2022, 1.9% in 2023, and 1.6% in 2024, upgraded from 2.1%, 0.9% and 0.9% respectively.

As for the economy, SNB still expected 2.5% GDP growth in 2022 while unemployment is “likely to remain low”. However, “if the energy supply in Europe were to be adversely affected, this could have a serious impact on the Swiss economy. The global supply bottlenecks and further increases in commodity prices could also slow growth. Furthermore, a resurgence of the coronavirus pandemic cannot be ruled out.”