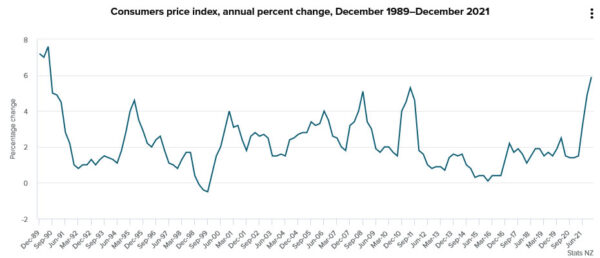

New Zealand CPI rose 1.4% qoq in Q4, above expectation of 1.2% yoy. Annual rate accelerated from 4.9% yoy to 5.9% yoy, above expectation of 5.6% yoy. That’s the highest level in three decades since 1990.

“New Zealand is not alone, with many other OECD countries experiencing higher inflation than in recent decades,” consumers prices senior manager Aaron Beck said. “Price increases were widespread with 10 out of 11 main groups in the CPI basket increasing in the year, with only the communications group decreasing.”

The data reinforces the case for RBNZ to raise interest rate in February. Westpac is forecasting a series of OCR hikes over the coming year with cash rat peaking at 3% in 2023. But New Zealand Dollar tumbles broadly following deep risk-off sentiment.

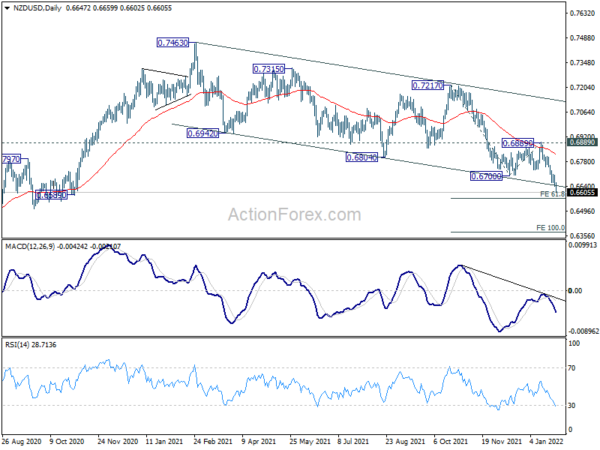

NZD/USD dives to as low as 0.6602 so far today as down trend continues. Next target is 61.8% projection of 0.7217 to 0.6700 from 0.6889 at 0.6569 and then 100% projection at 0.6372.

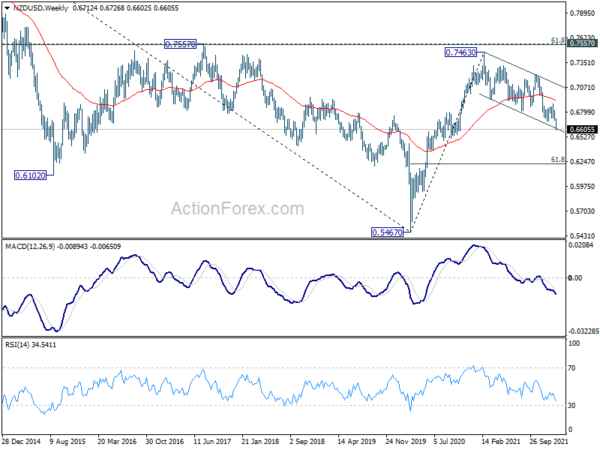

The strong break of medium term falling channel support indicates downside acceleration. Fall from 0.7463 could be a correction to up trend from 0.5467, or a impulsive down trend itself. In either case, NZD/USD would target 61.8% retracement of 0.5467 to 0.7463 at 0.6229 before making a bottom.