US stocks tumbled overnight and treasury yields surged after surprisingly hawkish minutes of December FOMC meeting. Firstly, “participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

More importantly, “almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate”. Also, once Fed starts to shrink its balance sheet, “the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode” in October 2017.

More on FOMC minutes:

- FOMC Minutes Extremely Hawkish, Pushing Stocks Lower and USD/JPY higher

- FOMC Minutes Reveal Greater Urgency to End Emergency-Level Monetary Policy

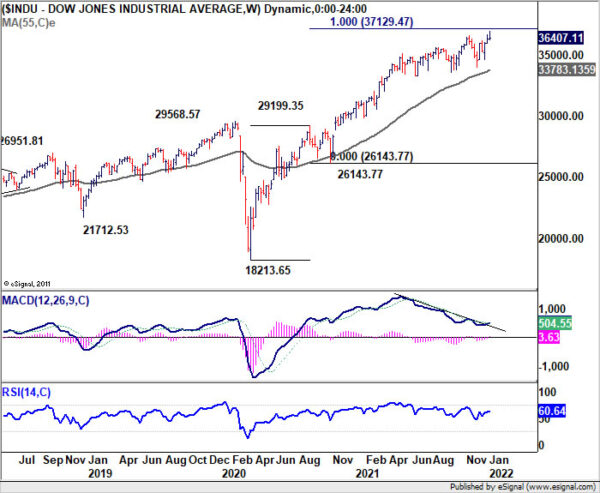

DOW closed down -1.07% or -392.54 pts at 36407.11. Despite the pull back, there is no threat to the up trend yet. However, it should not noted that DOW is close to an important fibonacci level of 100% projection of 18213.65 to 29199.35 from 26143.77 at 37129.47. Rejection by this level could trigger deep medium term correction through 55 week EMA (now at 33783.13).

Meanwhile, 10-year yield rose strongly by 0.037 to close at 1.705, breaking 1.693 near term resistance. The development is inline with the view that consolidation from 1.765 has completed after testing 55 week EMA. Up trend from 0.398 should be ready to resume. Break of 1.765 would send TNX through 2% handle to 61.8% retracement of 3.248 to 0.398 at 2.159.