New Zealand Dollar jumps broadly today as economists pull head their expectation on RBNZ rate hike. The change in forecasts came after strong NZIER Quarterly Survey of Business Opinion, which shows a sharp improvement in both business confidence and demand in firms’ own business.

General business confidence jumped to 10.1 in Q2, from Q1’s -7.9. Trading activity in the past three months rose to 25.6, from -0.4. Trading activity for the next three months rose to 27.6, from 7.8.

ASB Bank now predicts a rate hike from historical low at 0.25% in November. BNZ quickly followed in expecting a hike this November. Markets are indeed now pricing in 70% chance of that happening.

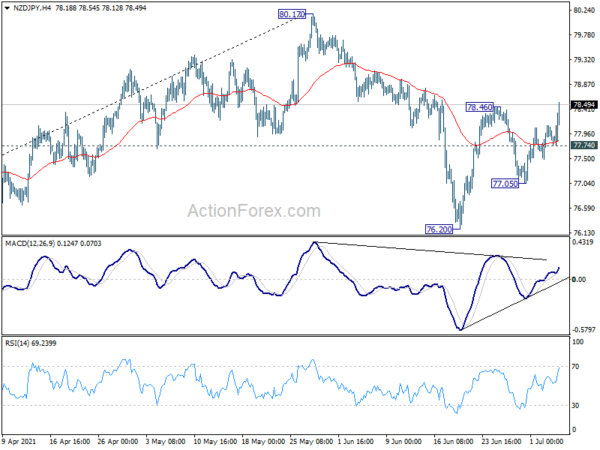

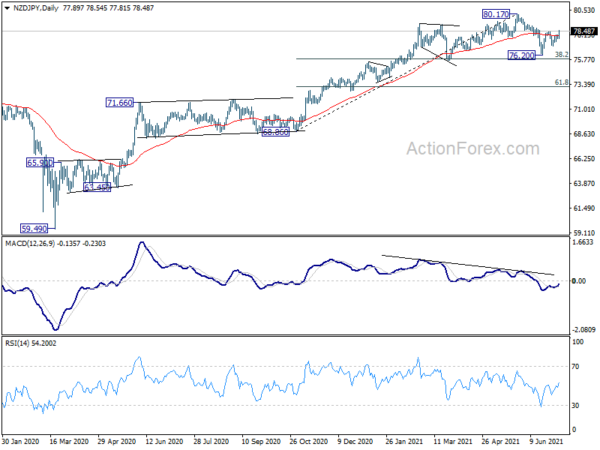

NZD/JPY’s break of 78.46 resistance now suggests that rebound from 76.20 is resuming. Further rise should be seen as long as 77.74 support holds, to retest 80.17 high. At this point, we’re not expecting a firm break of 80.17 to resume the up trend from 59.49 low yet. Consolidation pattern from 80.17 could still extend with another falling leg. We’ll keep an eye on the upside momentum to assess it again later.