US commercial crude oil inventories rose 1.3m barrels in the week ending May 14, below expectation of 1.5m barrels. At 486m barrels, oil inventories are about 1% below the five year average for this time of year. Gasoline inventories dropped -2.0m barrels. Distillate dropped -2.3m barrels. Propane/propylene rose 0.4m barrels. Commercial petroleum inventories dropped -0.2m barrels.

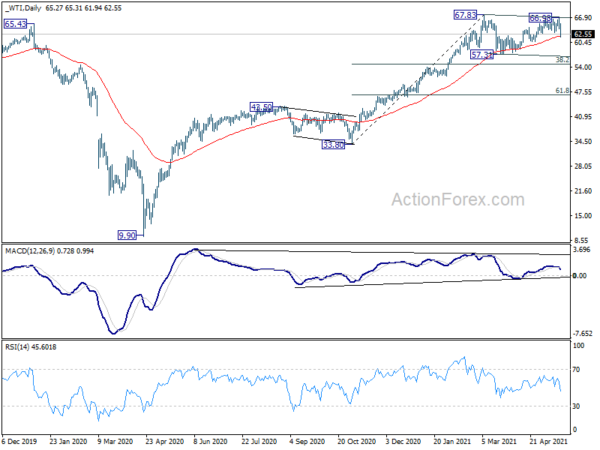

WTI crude oil drops sharply today, following broad based risk selloff. The current development suggest rejection by 67.83 high as expected. Rise from 57.31, the second leg of the consolidation pattern from 67.83, should have completed at 66.98. Deeper fall would now be seen to 60.62 support first. Break would target 57.31 support and possibly below. Tentatively, we’re looking for support from 38.2% retracement of 33.80 to 67.83 at 54.83 to complete the consolidation pattern.