Dollar is trying to make a come back with strong rally in US treasury yield, as also confirmed by the steep fall in gold. 10 year yield is trading up 0.145 at 0.965 at the time of writing. Technically, the strong break of near term channel resistance is a clear sign of upside acceleration. More importantly, 0.957 key resistance is violated too. Focus will now be on two things. Firstly, could TNX sustain above 0.957? Secondly could TNX breaks through 1% handle with conviction? If both happens, chance for a Dollar come back would increase.

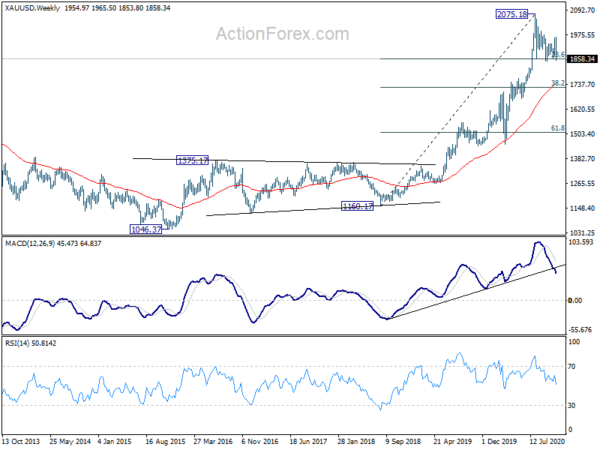

As for gold, the rejection from 1973.58 resistance retains near term bearishness. Focus is indeed back on 1848.39 support in Gold. Firm break there will resume the whole decline from 2075.18. In the bigger picture. Firm break of 1848.39 would raise that chance that fall from 2075.18 is a medium term correction, correcting the whole up trend from 1160.17. In that case, we might see gold falling further to 55 week EMA (now at 1737.56). We’ll see how gold, yield and Dollar interacts ahead.