While the forex markets are relatively steady today, oil price is suffering steep decline in the early part of European session. Demand concern is seen as a reason for the sell-off. The US reported its highest number of new coronavirus infections in the two days through Saturday. Numbers in Europe are also making record runs. The resurgence comes at a rather bad time when the Northern Hemisphere is now entering into winter.

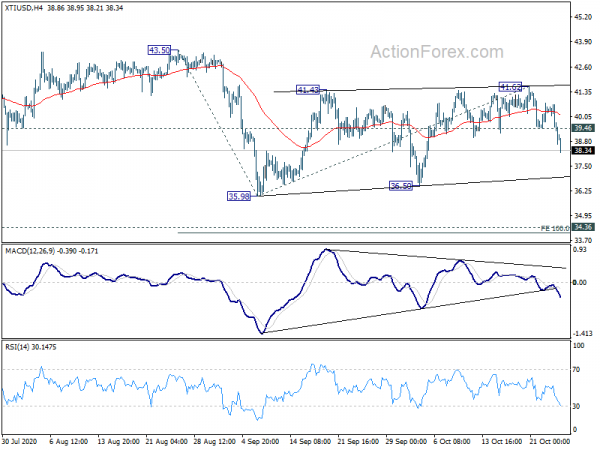

WTI crude oil’s decline is accelerating lower as seen in 4 hour MACD, with break of its trend line. The development now argues that price actions from 35.98 are a consolidation pattern completed with three waves to 41.62. That is, medium term correction from 43.50 is extending with another falling leg. Deeper fall would be seen, possibly through 35.98 low to 100% projection of 43.50 to 35.98 from 41.62 at 34.10. We’d expect strong support from there, which is close to 34.36 support to bring rebound. Meanwhile, near term downside risk will be erased if WTI could reclaim 40 handle.