US stocks closed higher overnight after Fed maintained the pledge to keep monetary policy loose and use all its tools to support the economy. Yet strength was limited as Chair Jerome Powell acknowledged that “data are pointing to a slowing in the pace of the recovery”.

“Recent labor market indicators point to a slowing in job growth, particularly among smaller businesses,” he added, and consumer surveys “look like they may be softening again now.” “There’s probably going to be a long tail where a large number of people are struggling to get back to work…. There will be a need both for more support from us and for more fiscal policy.”

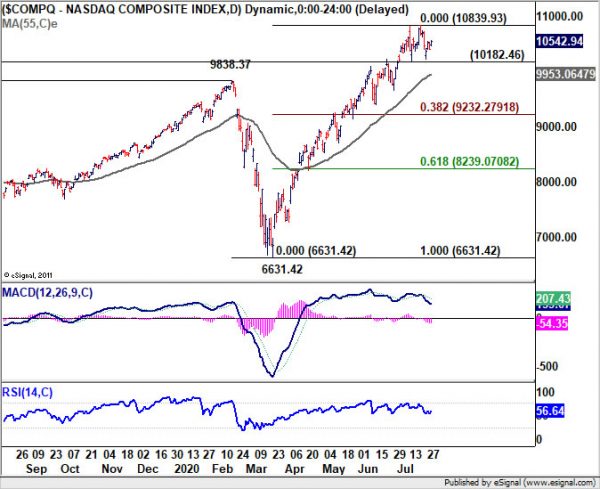

NASDAQ ended up 1.35% or 140.85 pts at 10542.94. Current development suggests that it’s merely in a near term sideway consolidation pattern, with near term bullishness intact. The record run should resume sooner rather than later as long as 10182.46 support holds. However, break of this support will argue that deeper correction is underway to 55 day EMA (now at 9953.05) and below.