New Zealand Dollar weakens broadly after RBNZ kept policy unchanged and issued a dovish statement, which hinted at further easing ahead. OCR was kept at 0.25% while quantum of the LSAP QE program was held at NZD 60B. In the discussions of the board meeting, the committee acknowledged the “improvements” in the outlook as the country has moved to coronavirus Alert Level 1 sooner than assumed. The government’s spending intentions was also larger than assumed and would provide more spending support than previously estimated.

However, members were concerned that the “positives could be short-lived given the fragile nature of the global pandemic containment”. It’s “not yet clear whether the monetary stimulus delivered to date is sufficient” and risks remain “skewed to the downside”. More importantly, members discussed the pros and cons of “expanding” the LSAP program, which would be driven by the outlook. A change in asset purchase size needs to be of “sufficient magnitude”. Staff are also “working towards ensuring a broader range of monetary policy tools would be deployable in coming months, including a term lending facility, reductions in the OCR, and foreign asset purchases, as well as reassessing the appropriate quantum of the current LSAP.”

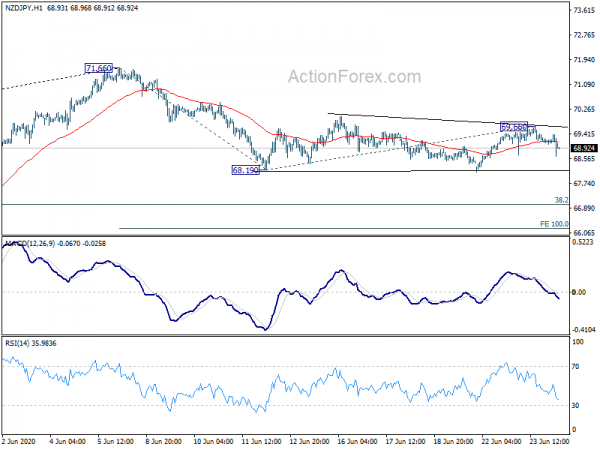

NZD/JPY dips notably after the release Current development suggests that price actions from 68.19 are merely a consolidation pattern, which could have completed at 69.66. Immediate focus is back on this 68.19 support. Break will extend the fall from 71.66.

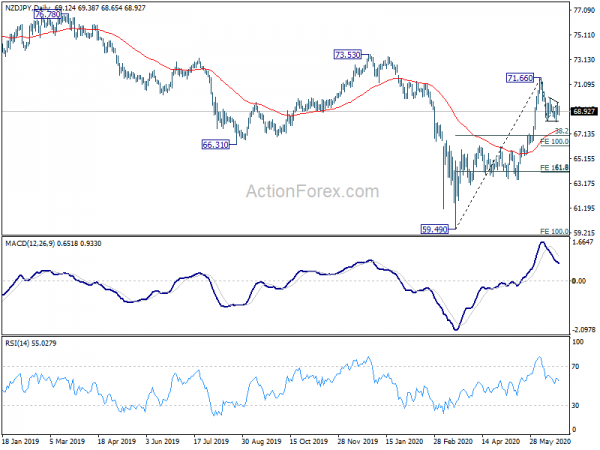

The decline from 71.66 is seen as a correction to the rebound form 59.49. It could dip into the 66.16/37.01 target zone (100% projection of 71.66 to 68.19 from 69.66 at 66.16, 38.2% retracement of 59.49 to 71.66 at 67.01) before completion.