Dollar turned mixed this week and extends the correction that started last Friday. In particular, USD/JPY was under heavy selloff on risk aversion and falling treasury yields overnight. 30-year yield hit record low at 1.811 before closing at 1.837, down -0.081. 10-year yield also hit 3-year low at 1.352 before closing at 1.377, down -0.094.

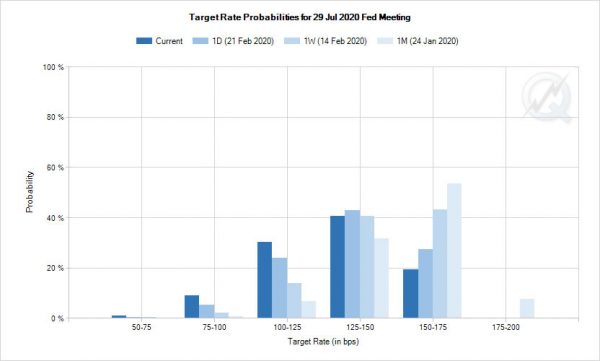

Traders are quickly increasing their bets that global coronavirus outbreak would eventually force Fed to cut interest rate again this year. Fed fund futures are now pricing in more than 80% chance of a cut by July meeting. It was 50-50 chance just a month ago.

Dollar index tumbled to as low as 99.11 on Fed cut speculations. But there is no change in the view that it’s merely in consolidation from 99.91 near term top. The index might gyrate lower for the near term. But we’d expect strong support from 38.2% retracement of 96.35 to to 99.91 at 98.55 to contain downside to bring rebound. medium term up trend is expected to resume through 99.91 at a later stage.