GDP growth slowed to 6.2% yoy in Q2, down from Q1’s 6.4% yoy, matched expectations. That’s also the slowest pace in at least 27 years. However, quarterly growth actually accelerated to 1.6% qoq, up from Q1’s 1.4% qoq and beat expectation of 1.5% qoq.

Also June’s data come in stronger than expected. But it remains to be seen if the momentum towards the end of the quarter could sustain. Headwinds from US tariffs and weaker global growth would still likely drag down China’s growth ahead.

Fixed assessment investment, excluding rural, rose 5.8% ytd yoy in June, up from 5.6% and beat expectation of 5.6%. Industrial production rose 6.3% yoy in June, up from 5.0% and beat expectation of 5.2%. Retail sales jumped 9.8% yoy, up from 8.6% yoy and beat expectation of 8.5% yoy. Surveyed unemployment rate rose from 5.0% to 5.1%.

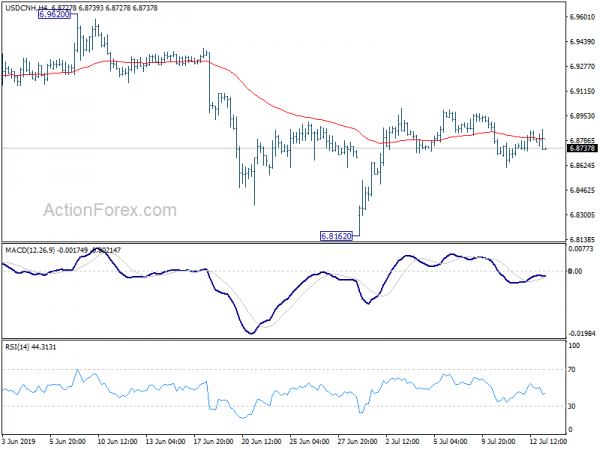

USD/CNH (offshore Yuan), dips mildly in Asian session but that’s mainly due to mild weakness in Dollar. Recent consolidation from 6.9620 is still in progress and would extend further in range.