US stock markets are in deep selloff today on trade war concerns. At the time of writing, DOW is down -365 pts or -1.41%. S&P 500 is down -1.39%. NASDAQ is down -1.59%. 10-year yield is down -0.047 at 2.435. Technically, the near term outlook in the indices are rather bearish too.

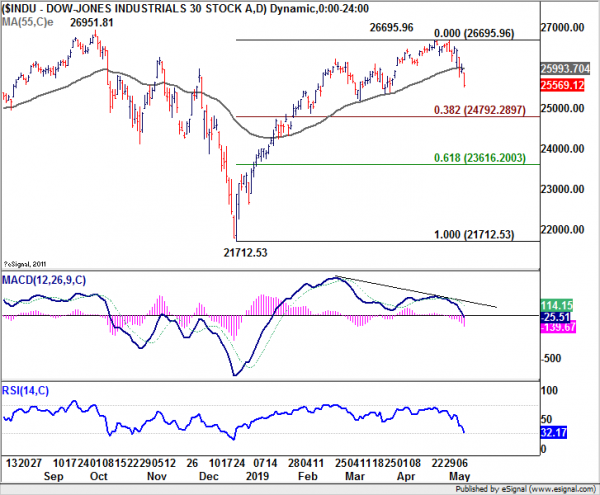

Regarding DOW, firstly, rise from 21712.53 is seen as the second leg of medium to long term consolidation pattern from 26951.81. (S&P 500 and NASDAQ broke respective historical highs but couldn’t sustain above. So, that doesn’t violate the view that equivalent rebounds were the second legs of corrective patterns too). Secondly, 26695.96 was reasonably close to 26951.81 high. Thirdly, bearish divergence is seen in daily MACD. Fourthly, 55 day EMA is now firmly taken out today.

The developments suggest that rise from 21712.53 has completed at 26695.96 already. And fall from there should be the third leg of the above mentioned corrective pattern from 26951.81. Further decline should now be seen back to 38.2% retracement of 21712.53 to 26695.96 at 24792.28. Sustained break there should confirm our view and target 61.8% retracement at 23616.20 and below.

Meanwhile, a turn around in US-China trade negotiation could reverse the decline in stocks. But could Chines Vice Premier achieve that? Theoretically yes but unlikely.