New Zealand Dollar drops notably today after weaker than expected job data. Employment contracted -0.2% qoq in Q1, below expectation of 0.5% qoq growth. Unemployment rate dropped to 4.2%, down from 4.3% and matched expectations. But labor force participation rate dropped -0.5% to 70.4%. Labor cost index rose 0.3% qoq, below expectation of 0.5% qoq.

Today’s data shouldn’t change RBNZ’s view that New Zealand is current staying at maximum sustainable employment. The reduced momentum in job growth and sluggish wage would provide little support to the already low inflation reading. Weak CPI is a key factor around the case of RBNZ rate cut in near term, probably in May, but the meeting remains live.

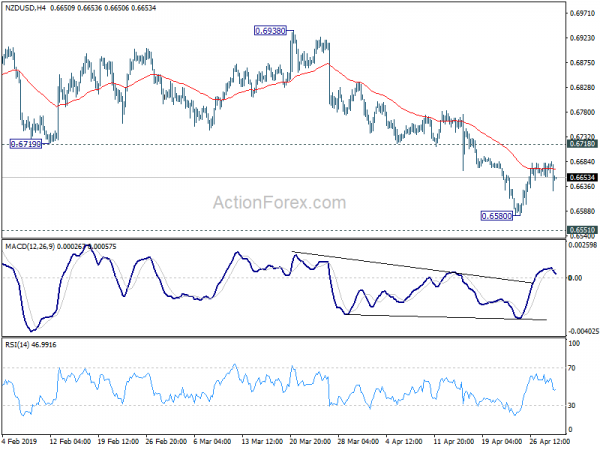

While NZD/USD dipped notably today, it’s staying in range above 0.6580 temporary low. More sideway trading remains in favor. But upside should be limited by 0.6718 resistance. Break of 0.6580 will target 0.6551 support next.