Entering into US session, Swiss Franc is trading as the weakest one for today despite mixed risk sentiments as seen in the stock markets. Rebound in gold and persistent rally in oil could be the factors that reduce safe haven demand for the Franc. Dollar is following as the second weakest, reacting negatively to news that Trump is going to escalate global trade war again by considering to impose new tariffs on EU products.

On the other hand, Australian Dollar is the strongest one, followed by Yen and Canadian. Rally in iron oil price is a factor lifting the Aussie. Meanwhile, there remains optimism that the worst in China slowdown is over, even though more data is needed to secure this view.

Sterling is mixed in range as UK Prime Minister Theresa May is in Berlin visiting German Chancellor Angela Merkel. There are speculations that EU prefers to give a relatively longer Brexit delay till end of 2019 or even March 2020. It’s perceived that UK will need more time to sort out what it really wants. In any case, for a short extension till June 30, May will be required to convince EU leaders that she has a plan to get the withdrawal agreement through the Parliament. And so it remains unlikely.

In Europe, currently:

- FTSE is up 0.01%.

- DAX is down -0.27%.

- CAC is up 0.01%.

- German 10-year yield is down -0.0078 at 0.003, staying positive.

Earlier in Asia:

- Nikkei rose 0.19%.

- Hong Kong HSI rose 0.27%.

- China Shanghai SSE dropped -0.16%.

- Singapore Strait Times rose 0.3%.

- Japan 10-year JGB yield rose 0.0015 to -0.044.

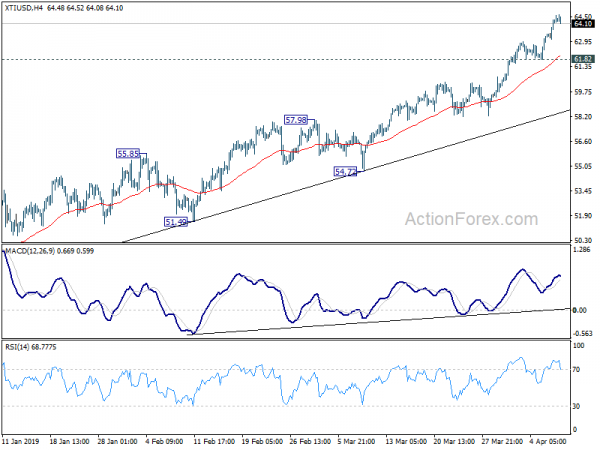

WTI crude oil hits as high as 64.64 and outlook remains bullish as long as 61.82 support holds.

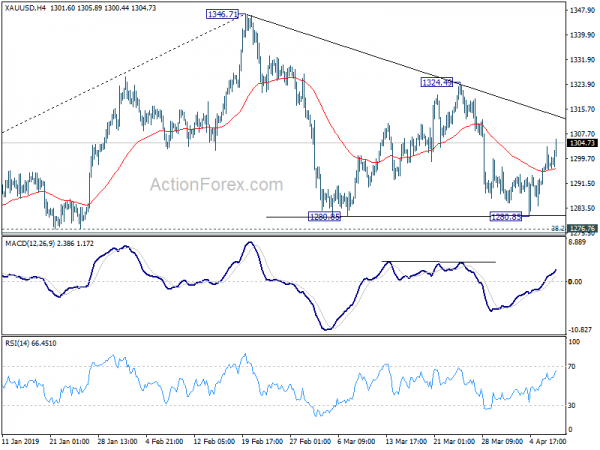

Gold’s rebound from 1280.85 is in progress fro 1324.49 resistance.