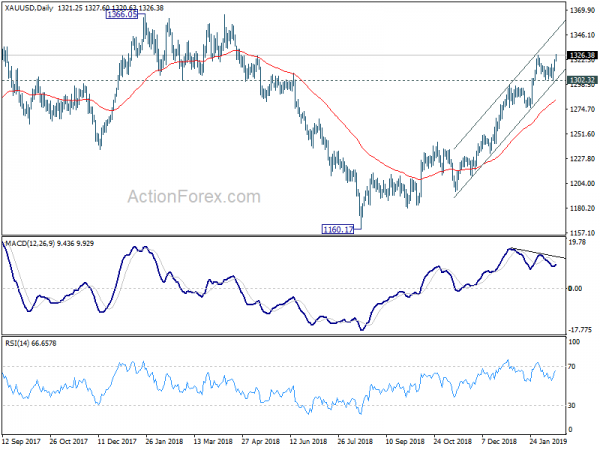

Gold’s recent up trend from 1160.17 (2018 low) resumed today by breaking 1326.25 and reaches as high as 1327.60 so far. Near term outlook will now remain bullish as long as 1302.32 support holds. And current rally would target next resistance at 1366.05 (2018 high).

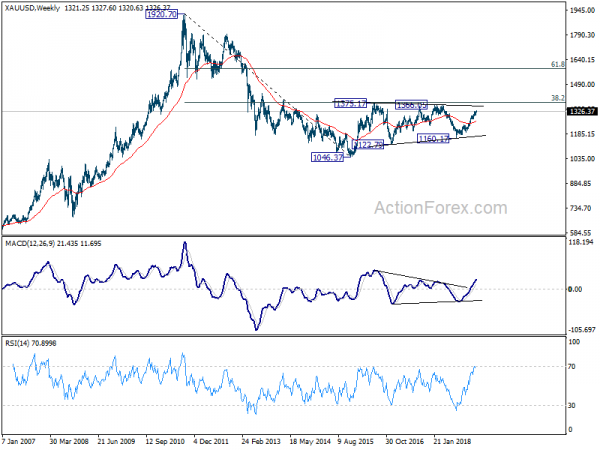

The question now is, whether gold is strong enough to resume the rebound from 1046.37 long term bottom (2015 low). That would imply a solid break of key fibonacci level of 38.2% retracement of 192.070 to 1046.37 at 1380.36. It tried this resistance twice since 2016 but failed.

As daily MACD now displays bearish divergence condition, we’d expect another failure this time. And, even if gold is to break 1380 eventually, a near term fall back, possibly back to 55 week EMA (now at 1265.20) would likely be seen first.

That is, while current rise might extend further, we’d expect upside to be limited below 1380 handle to bring near term reversal.