Dollar is rather strong today as lifted by surging US yields as well as rally is equities. Though, it’s slightly outperformed by Swiss Franc and Canadian Dollar. For the Swiss Franc, it’s resilience could be seen as a sign that investors still have many things to worry about, in particular in the emerging markets. Canadian Dollar might be lifted by oil price as WTI is back above 69.

Yen is apparently the weakest one as pressured by US yields and rally in US indices. Australian and New Zealand Dollar follow. Meanwhile, Sterling’s lift from Brexit optimism faded rather quickly. Rhetorics from all sides are pointing to a Brexit deal in 6-8 weeks. But the impact on the markets are just that.

Apple and Microsoft are the main drivers of the US stock markets. DOW is up 0.54% at the time of writing. S&P 500 up 0.49% and NASDAQ up 0.69% respectively. Five year yield is up 0.037 at 2.865, 10 year yield is up 0.035 at 2.972. European indices staged a strong rebound before close. FTSE ended just down -0.08% and DAX down -0.13%. CAC has indeed closed up 0.27%.

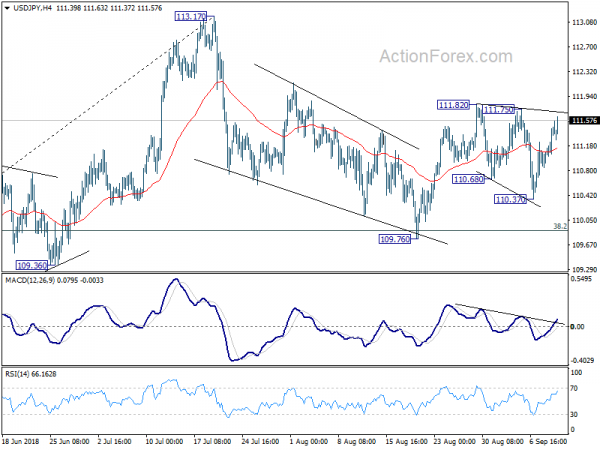

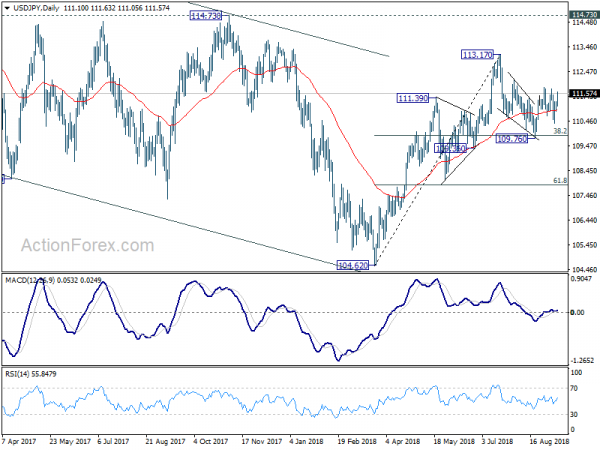

USD/JPY is a pair to watch for the rest of the session. 111.75/82 resistance zone is now within touching distance. Decisive break will resume the rebound from 109.76 and target 113.17. More importantly, this reaffirm our view that corrective from 113.17 has completed at 109.76 and whole rise from 104.62 is still in progress.