RBA rate decision is a focus in the upcoming Asian session. It’s generally expected to keep the overnight cash rate unchanged at 1.50%. There shouldn’t be any chance of any surprise in the decision. Meanwhile, the accompanying statement will likely be rather unchanged from the prior one.

The more interesting event could indeed be the Monetary Policy Statement to be released on Friday. There RBA will published updated growth, inflation and unemployment forecasts. Also, the forecasts horizon will extend to December 2020, from June 2020.

Currently a full 25bps rate hike is not priced in until late 2019.

Let’s have a look at some Australian Dollar crosses.

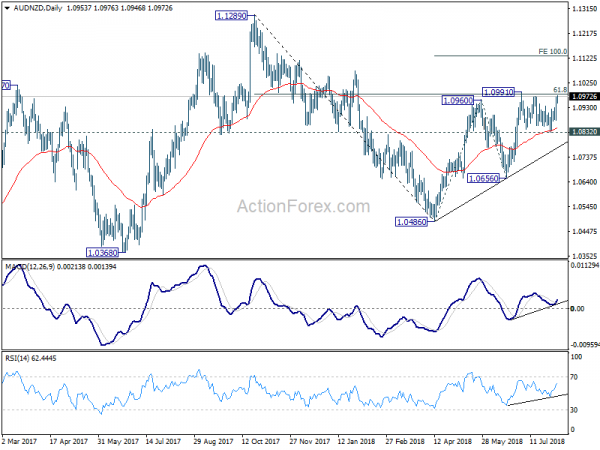

AUD/NZD is clearly in consolidation since 1.0991. Support was seen from the slightly rising 55 day EMA. Daily MACD an RSI also suggest building up of upside momentum. The current development favors an eventual upside break out. Fundamentally, it’s also consistent with the respective central bank’s stance. RBA maintains a tightening bias. RBNZ is neutral and the next both can be up or down.

Given that RBNZ will also meet this week, the immediate focus is on 1.0991 resistance for the next few days. Decisive break of 1.0991 will resume whole rise from 1.0486 and target 100% projection of 1.0486 to 1.0960 from 1.0656 at 1.1130. And in any case, near term outlook will remain bullish as long as 1.0832 support holds.

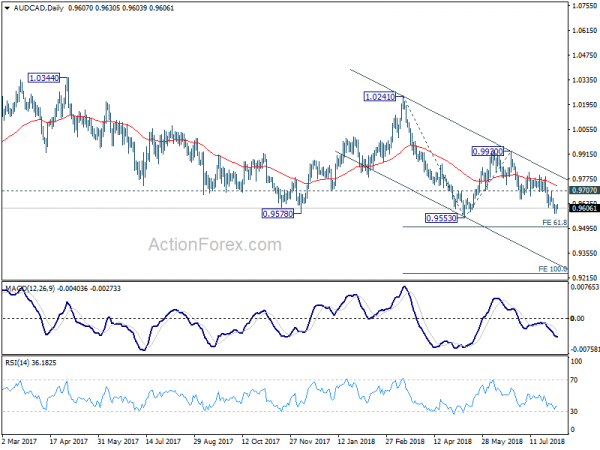

On the other hand, AUD/CAD has been in clear down trend. It’s primarily due to expectation that BoC is possibly on track for another rate hike in October. This week’s focus will be on 0.9553 low. Break there will extend the fall from 1.0241 to 61.8% projection 1.0241 to 0.9553 from 0.9930 at 0.9505 and then 100% projection at 0.9242 in medium term. ON the upside, though, above 0.9707 resistance will extend the consolidation pattern from 0.9553 with another rebound first.

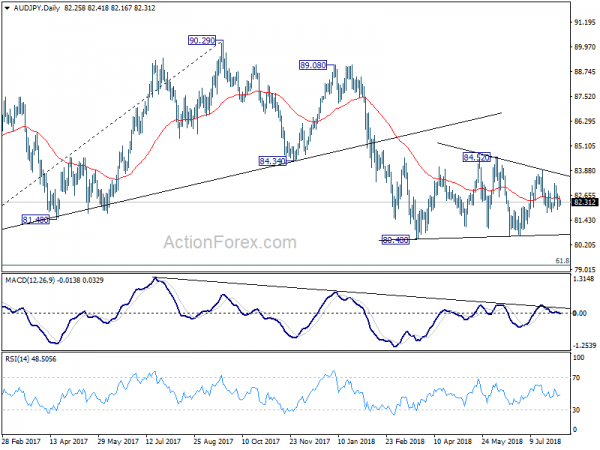

AUD/JPY is trading near to the mid-point of converging range from 80.48. There is no clear sign of a breakout yet. But outlook will stay bearish as long as 84.52 resistance holds. The downside from 90.29 is expected to resume eventually with a downside breakout. And break of 80.48 will target 61.8% retracement of 72.39 (2016 low) to 90.29 (2017 high) at 79.22.