Euro suffers steep selling after ECB’s announcement. ECB did deliver an the decision on asset purchase program. That is, tapering it for three months after September and end it after December. But the markets seem to be rather unhappy with it. The decision to taper, instead of ending it right after September could be a factor.

The more important one could be this part of the statement. “The Governing Council expects the key ECB interest rates to remain at their present levels at least through the summer of 2019 and in any case for as long as necessary to ensure that the evolution of inflation remains aligned with the current expectations of a sustained adjustment path.”

It suggests that for now, ECB is not even eyeing mid 2019 as the timing for the first rate hike.

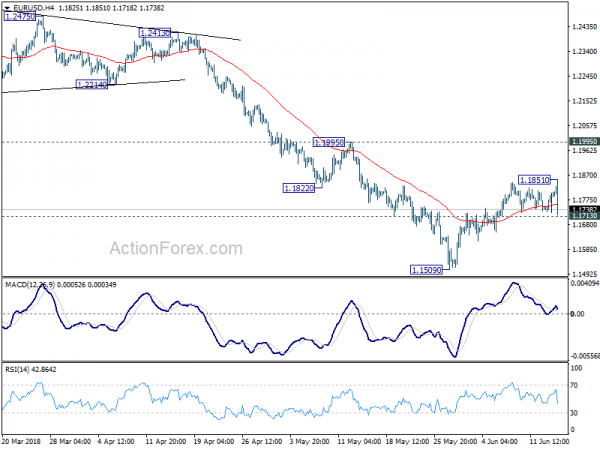

Focus on EUR/USD is now back on 1.1713 minor support. Break will bring retest of 1.1509 low next. Euro now looks to Mario Draghi’s press conference for rescue. Based on our experience on Draghi, he usually delivers something more cautious then the statements.