Summary

- After slowing through most of 2022, there are signs that Swiss economic growth is in the process of bottoming out. Sentiment surveys improved at the start of this year, while the growth outlook for the Eurozone—Switzerland’s main export partner—has also become more constructive. We now no longer forecast the Swiss economy to enter recession in 2023.

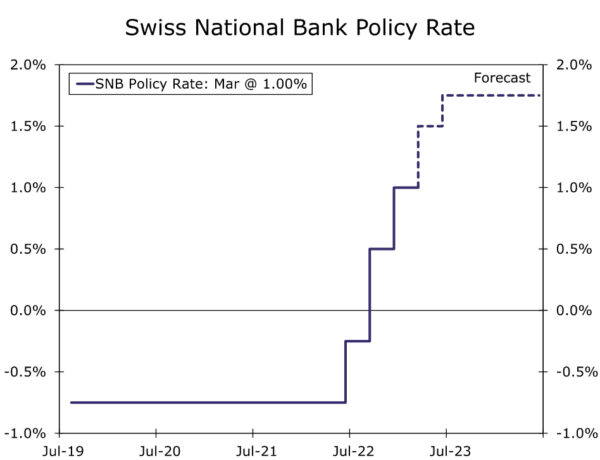

- There has been a renewed uptick in Swiss inflation in early 2023, including core inflation measures. This has prompted SNB President Jordan to say monetary policy is still too loose, and that further tightening is likely. Against this backdrop, we not only see a 50 basis point hike from the Swiss National Bank (SNB) in March, but also another 25 basis point hike in June, which would see a peak policy rate of 1.75%.

- We forecast SNB rate hikes to lag those of the European Central Bank, and also fall short of market-implied pricing. Thus, we view our more hawkish outlook for SNB monetary policy as consistent with moderate franc weakness versus the euro.

Swiss Growth Stabilizing in Early 2023

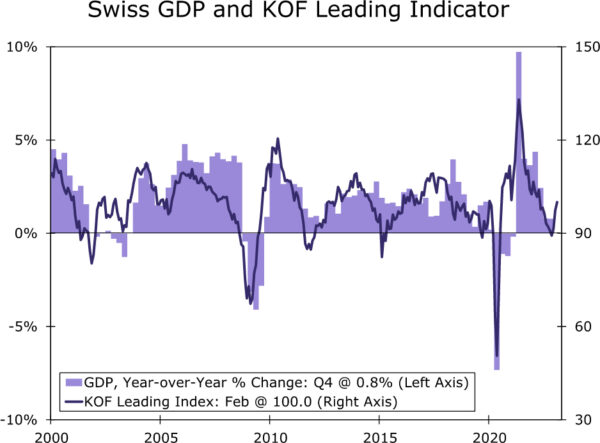

The Swiss economy slowed through most of last year, but as we turn the corner in 2023 there are signs growth is bottoming out and prospects for economic activity are improving. The low point (or slow point) for Swiss growth was arguably Q4-2022, when GDP was flat for the quarter on a sequential basis, but growth was steady at 0.8% year-over-year. The details within the Q4 GDP report were mixed. Domestic spending showed moderate gains, including a 0.3% quarter-over-quarter gain in consumer spending and a 1.0% gain in investment spending, but overall economic growth was held back by a 2.0% drop in exports.

There are reasons, however, to expect improving Swiss activity as 2023 progresses. As energy prices have receded, the outlook for the Eurozone has improved. Strengthening economic prospects for the Eurozone are a very important development for Switzerland, given the importance of the Eurozone as a trading partner, with some 38% of merchandise exports directed to its Eurozone neighbors. The closely followed KOF leading indicator has begun to reflect that improving outlook, rising to 100.0 in January from a recent low of 89.3 in November. Swiss consumer confidence (released at a quarterly frequency) has also improved, rising to -30.2 in Q1 from -46.5 in Q4. Only the manufacturing PMI has failed to show any meaningful improvement, printing at 48.9 in February. That said, considering a more resilient outlook for the Eurozone economy and improving confidence surveys locally, we see a stronger Swiss growth outlook for 2023 than previously. We forecast the Swiss economy to grow by 0.3% in 2023—modest, but still better than the 0.1% gain we forecast a month ago. While the growth outlook revision is modest, we also no longer forecast the Swiss economy to fall into recession this year. Lifting our recession forecast is especially notable, as we still believe the Eurozone and other European economies could experience a short-lived contraction in 2023.

Swiss Inflation Ticking Higher Again

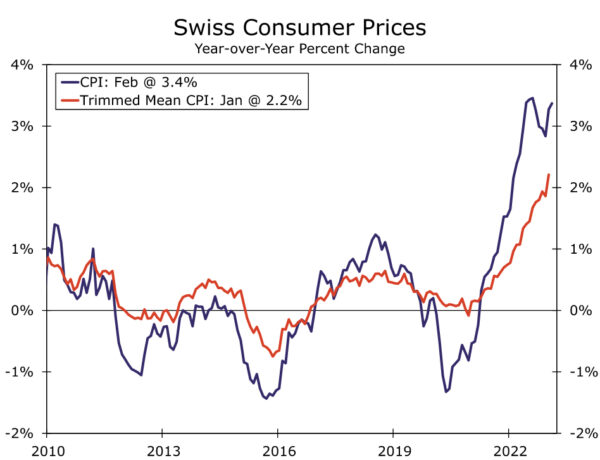

In addition to signs of stabilizing growth, the early part of this year has seen a renewed uptick in Swiss inflation. Headline CPI inflation quickened to 3.4% year-over-year in February, up from a recent low of 2.8% in December. Higher prices for airfares, package holidays, rents and gasoline were reason behind the acceleration. Importantly however, there have also been signs of broadening price pressures. Core CPI inflation as published by the Statistics Office firmed to 2.4% in February. Meanwhile, the trimmed mean CPI measure calculated and published by the Swiss National Bank (SNB) firmed to 2.2% in January, the fastest pace since 1993.

Given this renewed, albeit modest, rise in inflation, the Swiss National Bank has signaled the need for further monetary policy action. In an early March speech, SNB President Jordan said the “SNB’s monetary policy is still too loose to return inflation back to price stability in the medium term”, adding the central bank “cannot exclude that we have to tighten further.” Likely referring to the rise in core inflation measures, Jordan said it was not always possible to avoid second and third round effects in terms of price increases. Finally, Jordan said that in addition to raising interest rates, the SNB could also sell foreign exchange (i.e. buy the Swiss franc) as a means of containing inflation.

Given higher Swiss inflation, the guidance from the Swiss National Bank, and our outlook for further rate hikes from the European Central Bank, we expect the Swiss National Bank to raise interest rates by more than previously forecast. At its March meeting, we expect the SNB to raise its policy rate 50 basis points to 1.50%. We now also see a further 25 basis point increase in the policy rate at the June meeting, which would see the SNB Policy Rate peak at 1.75% for the current cycle. While the pace of rate hikes from the SNB is expected to lag those from the ECB, we view that as appropriate considering the scope of the inflation problem the Swiss central bank faces is far less pronounced than that faced by the ECB. We also note that our forecast for a peak SNB policy rate of 1.75% also falls short of market-implied pricing, which sees a peak policy rate closer to 1.94%. Thus, we still view our more hawkish outlook for SNB monetary policy as consistent with moderate franc weakness versus the euro, given that we expect SNB hikes to lag both those of the ECB as well as hikes implied by market pricing.