SNB raises the policy rate by 50bps to 1.00% as widely expected, to “countering increased inflation pressure and a further spread of inflation”. The central added that additional rate hikes “cannot be ruled out”. It also maintained the willingness to be “active in the foreign exchange markets as necessary”.

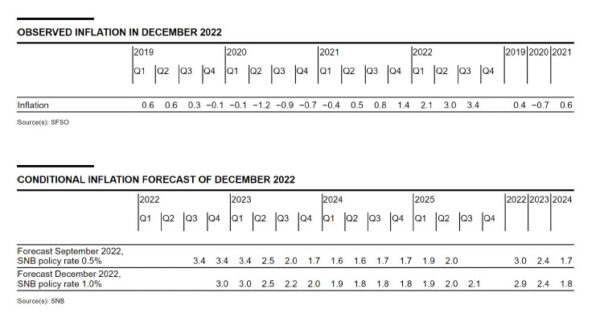

In the new conditional inflation forecast based on 1.0% policy rate, inflation forecasts was lowered from 3.0% to 2.9% in 2022, left unchanged at 2.4% in 2023, and raised from 1.7% to 1.8% in 2024. Inflation forecast was indeed raised from Q3 2023 through Q4 2024.

The higher inflation forecasts was “attributable to stronger inflationary pressure from abroad and the fact that price increases are spreading across the various categories of goods and services in the consumer price index.”

Regarding GDP growth, SNB expects its to be at around 2.0% this year. But weaker overseas demand and higher energy prices are likely to “curb economic activity marked in the coming year”. SNB expects GDP growth to slow to 0.5% in 2023.