While the world discusses the prospect of an embargo on Russian oil and gas, the absolute madness is in metals. In many of them, Russia has a pretty significant share, and investors fear a ban on exports could be Russia’s response to sanctions, on a par with restricting supplies of agricultural products.

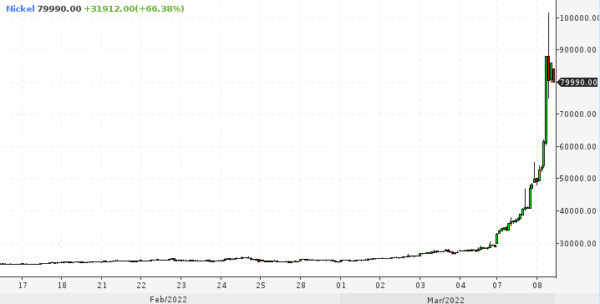

Palladium set a new all-time high at $3439 on Monday, gaining 14.8% on the day at one point. Nickel reached $100,000/tonne, gaining more than 200% over the two days, but soon retreated to $82,000 (+71% since the start of the day). Aluminium reached $4000 per tonne on Monday, compared with stabilization at $2600 from November to mid-December.

Copper exceeded $10800/tonne yesterday, rewriting its historic high.

Still, if we apply ‘peacetime’ patterns, we can see short-squeezes and a final capitulation by the bears in one metal after another. A reversal usually follows this.

Copper and palladium have been sliding hard after making new all-time highs, and we’re now seeing a distinct tug-of-war between the buyers and the sellers, at an impressive distance from yesterday’s extremes. Nickel is retracing a sharp bounce today.

The price of Gold troy ounce reached $2020 earlier on Tuesday, having hit new highs since August 2020. The momentum in gold gained new strength after restrictions from cryptocurrency exchanges for Russian residents.

But here, too, it is worth betting with great caution on the upside, as there will be a big seller entering the market. The Bank of Russia, for the most part, has no other means but to sell off the gold from its reserves in Russia. These steps could be taken tomorrow, as Monday and Tuesday were national holidays. Those actions will keep the price of gold on the way to the all-time highs near $2075, where it could be as early as this week.

However, the chances are higher that more sellers will enter into gold, which will cool the current rally, temporarily correcting the price into the $1960-2000 area before the end of March.