Bitcoin was in heavy selloff during the weekend, together with other crypto currencies. There’s unconfirmed news that the US Treasury is going to tighten up regulations to crackdown money laundering with digital assets. The selloff was also seen as hangover of Coinbase listing on NASDAQ last week. Some believed it’s related to the blackout in China’s Xinjiang region, which caused almost half of Bitcoin network to go offline in 48 hours.

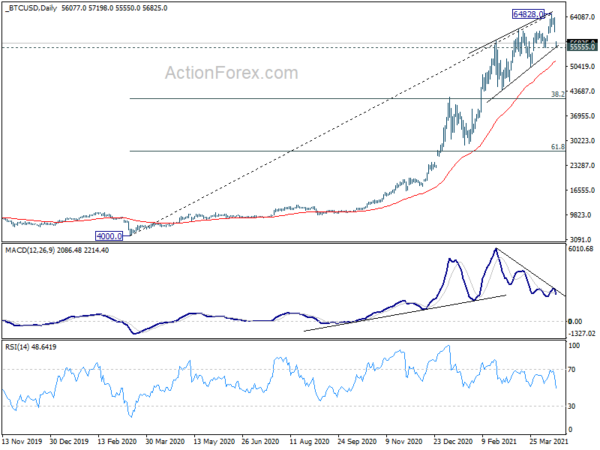

Technically, the decline wasn’t much a surprise to us. We have been seen price actions from 20283 as developing in to a five-wave terminal triangle. The break through 60726 to 64828 was a bit stronger than expected. But that’s kept by upper trend line of the triangle nonetheless.

Immediate focus is now on 55555 support, which is close to lower trend line of the triangle. Firm break there should confirm the start of a larger correction, to the whole up trend from 4000 (Mar 2020). The eventual depth of the correction would depend on the strength of the interim rebound. But we’d tentatively put 38.2% retracement of 4000 to 64828 at 41591 as target. That’s also close enough to top of prior range of 20283/41964.