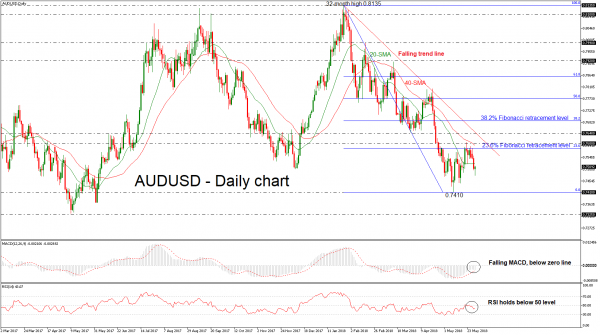

AUDUSD has been underperforming in the past three days, following the touch on the 23.6% Fibonacci retracement level of the downleg from 0.8135 to 0.7410, around 0.7580. Early this morning, the pair recorded a fresh two-week low of 0.7475 while it still trading below the 20-simple moving average (SMA) in the daily timeframe.

Short-term momentum indicators are also pointing to a continuation of the bearish bias. The MACD oscillator is heading south and is approaching the its trigger line, while the RSI indicator is developing below the threshold of 50.

Further losses should see the May 9 low of 0.7410 acting as a major support. A drop below this level would reinforce the bearish structure in the medium term and open the way towards the next key support level of 0.7325, taken from the trough on May 2017.

In the event of an upside reversal, the 23.6% Fibonacci mark at 0.7580 could act as a barrier before being able to re-challenge the 0.7600 handle. An upside extension would shift the medium-term outlook to a more neutral one as it would take the pair above the 40-day SMA. Further gains would lead the way towards the 0.7640 resistance level and the 38.2% Fibonacci of 0.7687.

In the bigger picture, AUDUSD is bearish as long as it holds below the descending trend line, which has been standing since January 26. In case it violates this line, bulls could take the upper hand.