Key Highlights

- Gold price formed a solid support around $1,285 and recovered against the US Dollar.

- There is a major bearish trend line formed with current resistance at $1,306 on the 4-hours chart of XAU/USD.

- The US S&P/Case-Shiller Home Price Indices rose 6.8% in March 2018 (YoY), more than the forecast of +6.4%.

- Today, the US GDP for Q1 2018 (Prelim) will be released, which is forecasted to grow by 2.3%.

Gold Price Technical Analysis

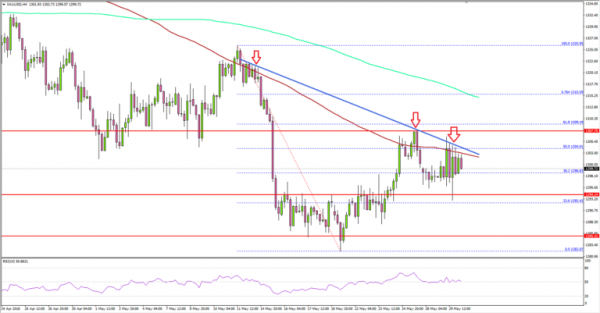

After a major decline, gold price found support above the $1,280-1,281 zone against the US Dollar. The price formed a support base and started an upside move above the $1.290 level.

There was a decent upside move and the price moved above the 23.6% Fib retracement level of the last decline from the $1,325 high to $1,282 low. There was also a break above the $1,300 level, but the price struggled to break the $1,308 resistance and the 100 simple moving average (red, 4-hour).

There is also a major bearish trend line formed with resistance at $1,306 on the 4-hours chart of XAU/USD. Moreover, the 50% Fib retracement level of the last decline from the $1,325 high to $1,282 low is near $1,305.

Therefore, it seems like there is a strong offer zone near the $1,305 and $1,310 levels. As long as the price is below these levels, it could decline back towards $1,285 in the near term.

On the flip side, a successful break above $1,310 and the 100 SMA could open the doors for a move towards $1,325.

Economic Releases to Watch Today

- German Consumer Price Index for May 2018 (Prelim) (YoY) – Forecast +2.0%, versus +1.6% previous.

- German Consumer Price Index for May 2018 (Prelim) (MoM) – Forecast +0.3%, versus 0% previous.

- German Retail Sales for April 2018 (MoM) – Forecast +0.6%, versus -0.6% previous.

- German Retail Sales for April 2018 (YoY) – Forecast 1.2%, versus 1.3% previous.

- Euro Zone Consumer Confidence May 2018 – Forecast 0.2, versus 0.2 previous.

- Euro Zone Services Sentiment May 2018 – Forecast 14.5, versus 14.9 previous.

- US Gross Domestic Product Q1 2018 (Preliminary) – Forecast 2.3% versus previous 2.3%.

- US Personal Consumption Expenditures Prices for Q1 2018 (QoQ) (Prelim) – Forecast +2.7%, versus +2.7% previous.

- BoC Interest Rate Decision – Forecast 1.25%, versus 1.25% previous.