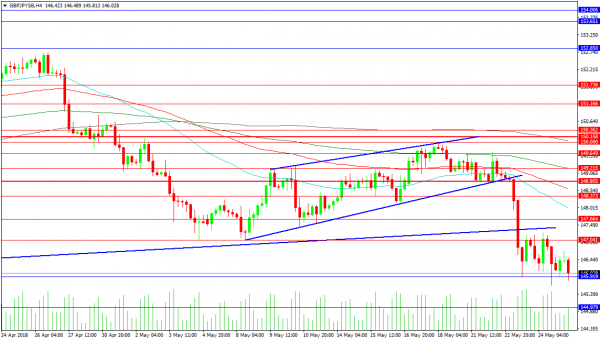

The GBPJPY pair has fallen under support this week, first at the 148.800 area and then the rising support trend line at 147.300. The market spent the last couple of weeks consolidating between 150.000 and 147.000 with these levels now becoming resistive. The low reached yesterday was 145.679 and a break under this level would target 145.000 as support with the previous swing low at 144.979. Continued downward pressure would likely look to supports at 144.440 and 144.000 followed by 143.750 and 143.000.

Resistance at the rising trend line can be found at 147.358 today should the price get above 147.000. A retest on this area could find sellers but a move higher can target the 148.000 level. Resistance levels can also be seen at 149.215 and 149.650. A move above 150.000 would seek to visit 151.000 followed by the 152.000 area and 152.700.

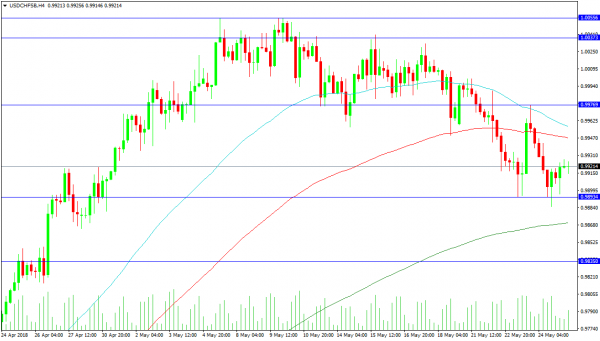

USDCHF

This pair has turned lower from a double top pattern at 1.00556 and having broken under the 1.00000 level is now using the 50 period MA as resistance at 0.99735. This has pushed price under the 100 period MA at 0.99522. The 0.99769 area is also providing resistance and this may block any move back higher for the near term. Failure to push higher above parity may develop into a deeper retracement. However should price action be driven higher there is a chance that a bullish breakout looks to test the recent highs and targets at 1.01000 and 1.01250 become available.

Support comes from the recent low at 0.98934 followed by the rising 200 period MA at 0.98675. A move under this MA would see the consolidation area at 0.98350 used to prop up price. A bounce from the 200 period MA would be comfortable for buyers but a loss could create a run on stops leading to a break under 0.98000 and target lower levels at 0.97091 and 0.96485.