Retail sales finally provided some encouraging news for the British economy. The Office for National Statistics (ONS) reported that retail sales grew 1.4% on an annualised basis in April, beating market expectations for a reading of 0.1%. The monthly growth read at 1.6%, more than double the expectation of 0.8%. This follows CPI reported yesterday which was below expectations at 2.4%. Strong retail sales tend to correlate with robust economic activity so this may be seen as an early indication that the U.K. economy is about to leave behind a recent soft patch. The ONS will release GDP data tomorrow which will help set expectations for a possible August rate hike by the Bank of England.

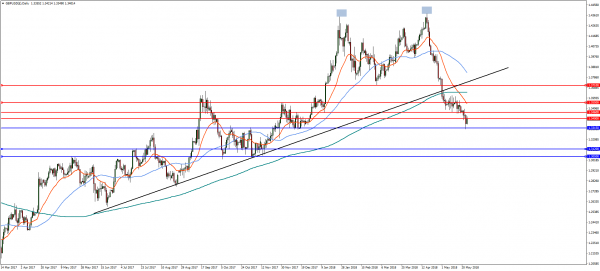

GBPUSD

On the daily chart, GBPUSD is attempting to regain the 1.34 level and a break could see the pair make further gains with resistance at 1.3460 and then the 23.6% retracement level at 1.3550. A sustained recovery will run into a confluence of trend line, Fibonacci and horizontal resistance at 1.3710. However, a drop though support at 1.3315 will see the pair resume the decline towards the double top target at 1.3050 with support at 1.3120.

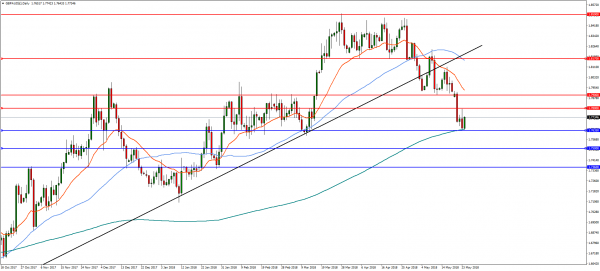

GBPAUD

On the daily chart, GBPAUD is finding support on the 200MA and 38.2% retracement of the lows from August at 1.7635. If this level breaks, the pair will resume the downside with supports at 1.7500 and then the 50% retracement at 1.7360. On the flip-side, a reversal above 1.7800 will open the way for gains towards resistance at 1.7900.