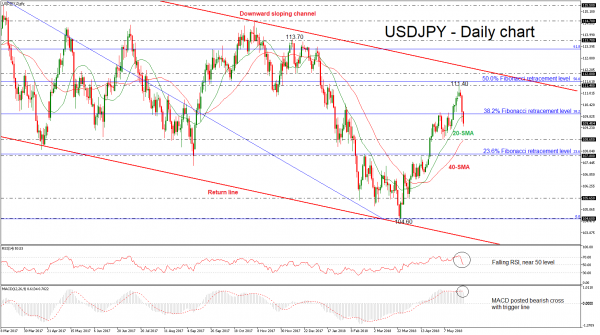

USDJPY has been plunging since Tuesday’s trading session after the strong bounce off the four-month high of 111.40. The pair almost pared the previous week’s gains and slipped below the 38.2% Fibonacci retracement level of the downleg from 118.60 to 104.60, near 109.95. The short-term technical indicators are bearish and point to more weakness in the market.

Looking at the daily timeframe, prices also fell below the 20-day simple moving average (SMA), while the RSI indicator dived near the neutral threshold of 50 with strong momentum. Moreover, the MACD oscillator created a bearish cross with its trigger line in the positive area.

If price action remains below the aforementioned obstacles, there is scope to test the next immediate support of 108.65, which holds near the 40-day SMA. Falling below it would see prices re-test the 107.80 barrier, which is near with the 23.6% Fibonacci mark. This is considered to be a strong support zone which has been rejected a few times in the past.

In case of an upward movement above the 38.2% Fibonacci level, then the focus would shift to the upside towards the four-month high. Slightly above it, the price could hit the 50.0% Fibonacci, which is acting as a strong resistance level at 111.60, before being able to challenge the 112.00 handle.

In the longer timeframe, USDJPY has been trading within a channel tilted slightly to the downside since December 2016.