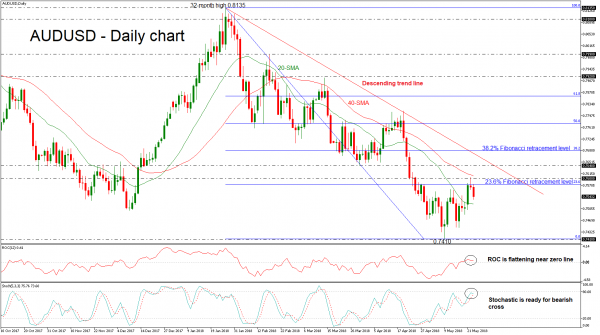

AUDUSD ended Tuesday’s session in the red after an aggressive bullish rally as it found strong resistance at the 0.7600 handle and at the 23.6% Fibonacci retracement level of the downleg from 0.8135 to 0.7410, around 0.7580. The price challenged a new one-month high of 0.7604 and approached the 40-day simple moving average (SMA).

The negative bias in the near term is supported by the deterioration in the momentum indicators. The %K line of the stochastic oscillator has fallen before touching the overbought levels and is attempting a bearish crossover with the %D line. However, the ROC is flatlining at the zero-neutral level, suggesting any upside correction will be weak.

Immediate support is being provided by the 20-day SMA near 0.7520. However, should prices dip lower again, the next support would likely come from the 0.7410 barrier, taken from the trough on May 9. Further losses could drive the pair towards the next level of 0.7325, identified by May 2017.

In case of an upward attempt, AUDUSD would likely meet resistance at the 0.7580 – 0.7600 area, which includes the 23.6% Fibonacci. A break above this region would ease the downside pressure and prices could hit the 0.7640 resistance. A significant leg above this level could send prices towards the 38.2% Fibonacci mark of 0.7687, which stands near the descending trend line.

In the medium-term, the bearish picture remains intact, as the pair has been developing within a downward trend following the bounce off the 32-month high of 0.8135 on January 26.