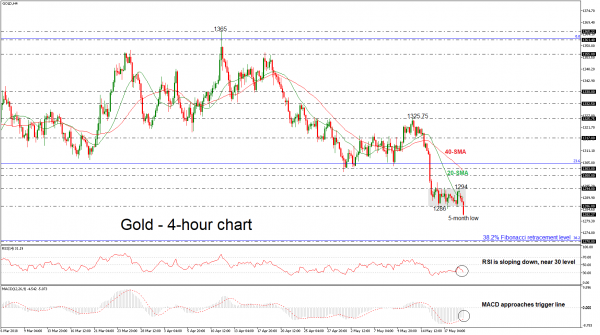

Gold is on course to post a strong trading day of losses, which have taken the price towards a fresh five-month low of 1281.96. The sharp sell-off, especially in the past week, has shifted the near-term bias from neutral to negative. The momentum indicators are supportive of the bearish picture in the 4-hour chart.

The RSI is currently increasing negative momentum towards its 30 level and is approaching the oversold level, while the MACD oscillator is moving lower below the zero line, both hinting that the next move in prices could be further to the downside.

Should the market extend losses, as the price slipped below the narrow range of 1286 – 1297, support would be met at the 1270 barrier, which overlaps with the 38.2% Fibonacci retracement level of the upleg from 1122 to 1355. A significant leg below this area could open the way towards the 50.0% Fibonacci near 1242.

On the flip side, if the pair bounces up, immediate resistance could be met at the 1294 resistance level. A jump above this zone could extend gains until the 1300 – 1303 region, where the 40-simple moving average (SMA) holds within this area.

In the bigger picture, the precious metal is bearish as long as it holds below the SMAs and has plunged below 1286 over the last hours.