Key Highlights

- The US Dollar traded higher this week and settled above 110.00 against the Japanese Yen.

- There is a major bullish trend line forming with support at 109.80 on the 4-hours chart of USD/JPY.

- Japan’s National Consumer Price Index in April 2018 came in at 0.6%, compared with the forecast of 0.7% (YoY).

- The National Consumer Price Index Ex Fresh Food posted 0.7%, less than the last 0.9%.

USDJPY Technical Analysis

The US Dollar started a major upward move from the 109.20 level against the Japanese Yen. The USD/JPY pair traded higher and settled above the 110.00 resistance to set the pace for more gains.

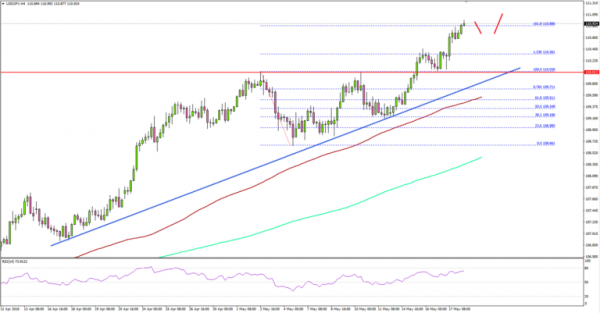

Looking at the 4-hours chart, there is a clear uptrend in place from the 109.00 support zone. The pair followed a bullish path and moved above the 1.236 Fib extension of the last decline from the 110.03 high to 108.66 low.

It settled above 110.00 and is currently poised to extend gains. It even tested the 1.618 Fib extension of the last decline from the 110.03 high to 108.66 low at 110.88.

On the downside, there are many supports around the 110.00 level. There is also a major bullish trend line forming with support at 109.80 on the 4-hours chart of USD/JPY.

Moreover, the 100 simple moving average (4-hour, red) is positioned below the trend line with a bullish angle at 109.50. Therefore, if the pair corrects lower, it is likely to find bids near 110.10, 110.00 and 109.80.

Recently, the US Initial Jobless Claims for the week ending May 12, 2018 was released by the US Department of Labor. The market was looking for a rise in claims from 211K to 215K.

The actual result was disappointing as there was a rise in claims to 222K. The report added that:

The 4-week moving average was 213,250, a decrease of 2,750 from the previous week’s unrevised average of 216,000. This is the lowest level for this average since December 13, 1969 when it was 210,750.

Overall, the US Dollar remains in an uptrend. EUR/USD and GBP/USD pairs are likely to struggle, whereas USD/JPY may continue to rise in the near term.

Economic Releases to Watch Today

- Euro Zone Trade Balance March 2018 – Forecast €20.7B versus €21.0B previous.

- Canadian Consumer Price Index April 2018 (MoM) – Forecast +0.4%, versus +0.3% previous.

- Canadian Consumer Price Index April 2018 (YoY) – Forecast +2.3%, versus +2.3% previous.

- Canadian Retail Sales March 2018 (MoM) – Forecast +0.3%, versus +0.4% previous.

- Canadian Retail Sales ex Autos March 2018 (MoM) – Forecast +0.5%, versus 0% previous.