AUDJPY posted a four-week high of 83.36 earlier on Thursday, while it is currently trading not far below that peak.

Indicative of the positive momentum is the fact the pair finished higher in five of the last six trading days, while it is looking set for a positive close today as well. Adding to the view for a positive short-term bias is the RSI indicator which is in bullish territory above 50 and continues to rise.

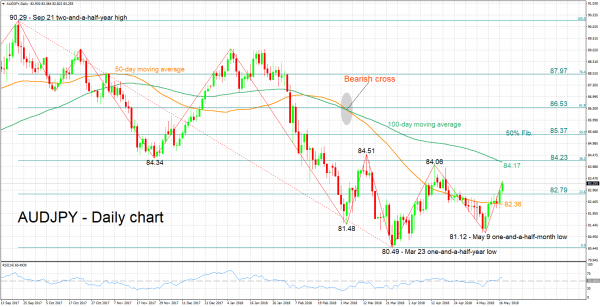

Resistance to further gains might come around the 38.2% Fibonacci retracement level of the September 21 to March 23 downleg at 84.23. The region around this level includes the 84 round figure, as well as the current level of the 100-day moving average and a few tops and bottoms from the past. Stronger bullish movement would increasingly start bringing into focus the 50% Fibonacci mark at 85.37.

On the downside, support could be met around the 23.6% Fibonacci level at 82.79 – including the 83 handle – and further below from the area around the current level of the 50-day moving average at 82.36.

In terms of the medium-term outlook, a bearish cross was recorded in early March when the 50-day MA moved below the 100-day one. However, the price crossing above the 50-day MA recently and being roughly equidistant from the current levels of the 50- and 100-day MAs at the moment, is on balance projecting a mostly neutral medium-term picture.

Overall, the short-term bias is looking bullish and the medium-term looks predominantly neutral.