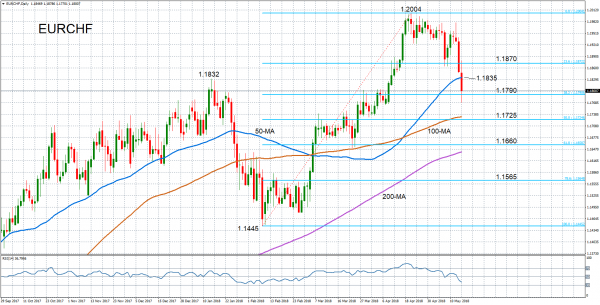

EURCHF is on course for a fourth straight day of losses, which have taken the pair from above the 1.19 level to a one-month low of 1.1770 today. The sharp sell-off, especially in the past two sessions, has shifted the near-term bias from positive to negative. The momentum indicators are supportive of the bearish picture, with the RSI falling into negative territory below 50 and approaching the 30 oversold mark.

Immediate support is being provided by the 38.2% Fibonacci retracement of the upleg from 1.1445 to 1.2004, around 1.1790, as prices bounced back above this level after briefly tumbling below it. However, should prices dip lower again, the next support would likely come from the 50% Fibonacci retracement around 1.1725. A drop below the 50% Fibonacci level would signal the start of a deeper bearish phase.

In case of an upward attempt, EURCHF would likely meet resistance at the 50-day moving average (MA), currently around 1.1835. A break above the 50-day MA would ease the downside pressure, while a climb above the 23.6% Fibonacci level at 1.1870 would help turn the short-term bias to a bullish one.

In the medium term, the bullish outlook remains intact, with the moving averages all pointing upwards. However, should prices decline towards the 100-day MA, this would risk shifting the medium-term picture to a more neutral one.