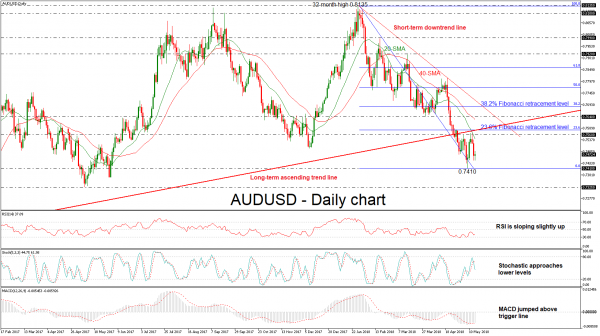

AUDUSD has reversed back down again after finding resistance at the 0.7560 barrier, achieved on Monday and holds below the 0.7800 handle. The pair completed two consecutive bearish days and remains below the 20- and 40-simple moving averages (SMAs) in the daily timeframe. However, Wednesday’s trading session started in positive territory.

In the short-term, the momentum indicators seem to be in confusion. The RSI indicator is pointing slightly north, while is holding in negative. Also, the MACD oscillator climbed above the trigger line with weak momentum. But, the stochastic oscillator created a bearish cross below the oversold levels and is moving lower.

In case of further losses, the 0.7410 support level should act as a major support. A drop below this area would reinforce the bearish structure and open the way towards the next key support level of 0.7325, identified by the May 2017 low.

In the event of an upside reversal, the 0.7560 and the 23.6% Fibonacci retracement level of 0.7580 of the downleg from 0.8135 to 0.7410 could act as a significant resistance zone. A continuation of the bullish bias would shift the medium-term outlook to a more neutral one as it would take the pair towards the 0.7640 barrier, which holds near the 40-SMA and next until the 38.2% Fibonacci of 0.7685.

Overall, for a resumption of the longer-term uptrend, which was halted in April, AUDUSD would need to climb back above the ascending trend line and beat the 32-month peak of 0.8135, creating a new multi-month high.